In general, value hunting in stocks that have fallen more than 70% at any point in history can be risky. History suggests that winning stocks continue to win, and investors are better off “watering the flowers and digging the weeds.”

However, there are exceptions to this concept.

Take it Paycom (NYSE: PAYC) And its human capital For example, a human management (HCM) software as a service (SaaS) solution. The stock is currently down 70% from its high. In 2019, the startup had revenue of about $600 million and the stock price was about $170. Today, the stock price is the same, but the revenue has basically tripled.

This, combined with Paycom’s resilient free cash flow generation, means the company is now trading at a valuation that could be validated by a once-in-a-decade valuation. While the market remains uncertain about the company’s growth story, there is a case to be made for buying and holding Paycom forever.

Why Paycom’s Current Growth Slowdown Isn’t a Doomsday Scenario

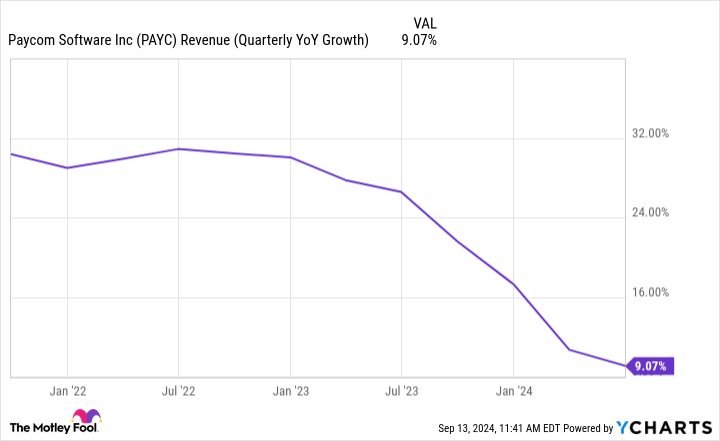

The main reason for Paycom’s stock price decline is due to declining revenue growth.

While the slowdown is concerning, management claims much of the decline is due to the introduction of the Beti payroll processing platform in late 2021. By empowering employees to manage their own payroll, Beti identifies and corrects many common errors before the company processes a payment, reducing the number of payroll reruns required.

Obviously, this is a fantastic thing for Paycom’s customers, one of whom said that Beti’s time-saving value enabled them to cut their payroll department in half. However, before Beti, Paycom was generating revenue by re-running payroll for customers whenever there was an error. Simply put, the company’s success New products are encroaching on existing sales bases.Growth is slowing.

Ultimately, investors who think in decades rather than quarters should welcome this balance between cannibalizing existing sales and providing customers with the best possible product while satisfying them as much as possible. Thanks to this focus on customer satisfaction, Paycom’s Net Promoter Score (NPS) of 67 easily outpaces that of its payroll processing competitors. Paychecks, Working daysand ADPThey have scores of -14, 31, and -10 respectively. The company’s NPS uses a scale of -100 to 100, with scores higher than 0 indicating that more customers would not recommend the product to a friend. In other words, Paycom’s products are loved.

The best part for investors is that the company’s Q2 earnings call provided some indications that this slowdown in revenue growth may be coming to an end. Founder and CEO Chad Richson said the company sold 24% more units in Q2 than the year-ago quarter, which is more promising than Paycom’s 9% quarterly revenue growth. In addition to those promising numbers, Richson said that “July started off 40% higher from a revenue perspective,” indicating that Q3 could see even higher revenue growth.

Additionally, with Beti’s recent launch in Canada, Mexico, the UK and Ireland, Paycom will be able to grow even further as it expands to serve customers with global operations.

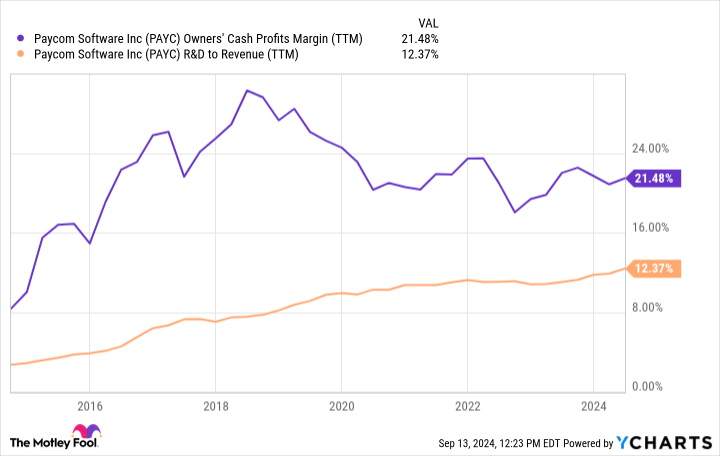

Increased cash generation despite increased R&D spending

What I like most about Paycom is their focus on innovation and making their customers as happy as possible. Over time, by increasing their spending on research and development (R&D), the company continues to enhance automation capabilities across their product lines. Despite this increased R&D spending, Paycom’s free cash flow (FCF) generation has proven to be incredibly resilient.

Paycom has consistently proven that new offerings create enough value to offset the R&D costs required to build them, with automated offerings like GONE, the company’s new leave request tool. Here’s how the company describes the value GONE brings to its customers: “According to a November 2023 Ernst & Young study commissioned by Paycom, each manual leave review or approval costs a company $30.92 on average.”

Paycom, which has maintained its status as a true cash cow while increasing its R&D spending, is a strong candidate to become a top-tier conglomerate in the long term.

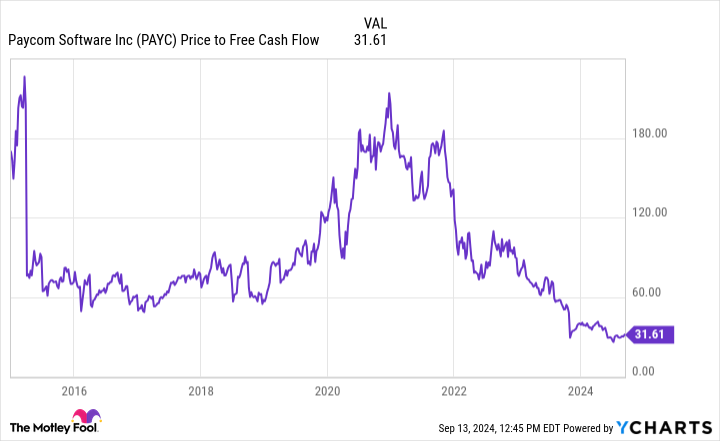

Paycom’s once-in-a-decade evaluation is likely to happen

While Paycom’s growth prospects and automation offerings look very bright, the company is trading at a once-in-a-decade low price-to-FCF ratio.

With a balance sheet of $346 million in cash and $0 in long-term debt, management has begun buying stock at these low prices and has now approved a $1.5 billion stock buyback. Given the company’s market cap of $9.7 billion, this buyback approval could be a major boost to Paycom’s stock price.

Finally, Paycom pays a 0.9% dividend, but has not raised it since it started six quarters ago. While a dividend increase would be nice for investors, management may be more focused on buying the stock at today’s prices.

Ultimately, I believe Paycom’s revenue growth will turn around in the coming years. This turnaround, combined with Paycom’s history of profitable product innovation, makes me excited to buy the stock at this once-in-a-decade valuation and hold it for the long term.

Should you invest $1,000 in Paycom Software right now?

Before buying Paycom Software stock, consider the following:

that Motley Fool Stock Advisor The analyst team just confirmed what they believed. Top 10 Stocks Investors should buy now… and Paycom Software wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the coming years.

When do you consider it? Nvidia We compiled this list on April 15, 2005… If you had invested $1,000 at the time of our recommendations, You will have $729,857!*

stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on portfolio construction, regular analyst updates, and two new stock recommendations each month. stock advisor There is a service Increased by more than 4 times The recovery of the S&P 500 since 2002*.

*Stock Advisor returns returns as of September 9, 2024.

Josh Cohn-Lindquist He holds a position at Paycom Software. The Motley Fool holds a position at Paycom Software and Workday and recommends them. The Motley Fool holds a position at Paycom Software and Workday and recommends them. Public Policy.

Once-in-a-Decade Opportunity: 1 Super Growth Stock That Falls 70% and You Need to Buy and Hold Forever Originally published by The Motley Fool.