In essence, GDPNOW in zero growth. Industrial production, retail sales (control) amazing disadvantages.

Figure 1: Figure 1. GDP (BOLD BLACK), WSJ January Survey (Blue), WSJ APRIL SURVEY MEAN (TAN), 4/16 (Sky Blue Square), Goldman Sachs 4/16 (Inverted Triangle) Billions of dollars CH.2017 $ Saar. Source: BEA 2024Q4 3rd release, WSJ survey.

In other words, net export provides a great negative contribution in the sense of accounting for Q1 GDP (-2.86 pPTS Q/Q Ar).

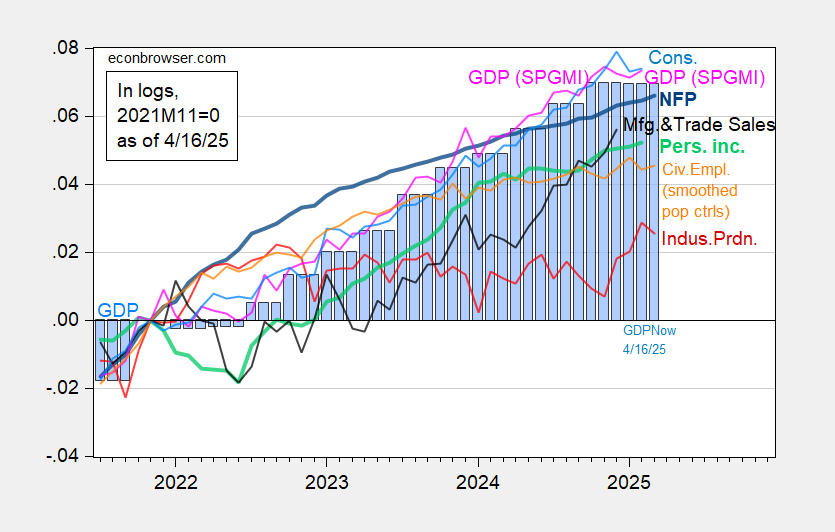

The business cycle indicators reinforced today by industrial production show a slowdown. But we still have no critical consumption and personal income in March.

Figure 2: Figure 2. Bold Blue’s benchmark revision employment, civilian employment, formula (orange), industrial production (red), CH.2017 $ (black), CH.2017 $ (PINLY GDP), CH.2017 $ (PINLY GDP), Employment of civilian employment benchmarks, including personal income except personal income except personal income except for the manufacture and trading of PINPLY GDP. GDP (Blue Bars), all logs are normalized at 2021m11 = 0. Source: BLS Fred, Federal Reserve, BEA 2024Q4 3rd Release, S & P Global Market Insight (Nee macro economic advisor, IHS Markit) (4/1/2025 release) and the calculation of the author.

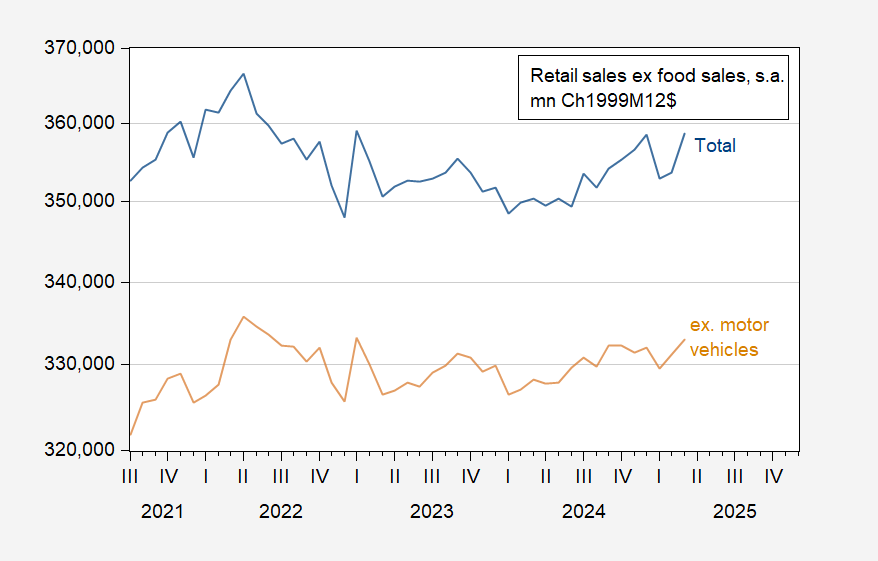

The following is a photo of all food sales and all motor vehicles.

Figure 3: Sales sales (blue) before the total retail sales (blue), retail sales and all motor vehicles (TAN), Mn.ch.1999m12 $, SA Source: BEA, BLS Fred and Author Calculation.

According to my accounting, nominal vehicle sales have increased by 13% m/m (annual), while non -automobile sales have increased by 0.5%, that is, the aim of increasing car prices.