Recent forecasts suggest a recession is not in sight, and forecasts have been revised upwards as of Q2.GDPNow, New York Federal), weekly indicators (Louis, Mertens, Stock; Baumeister, Leyva-Leon, Sims) growth is rising, with both the NBER BCDC indicator and the alternative indicators showing positive growth.

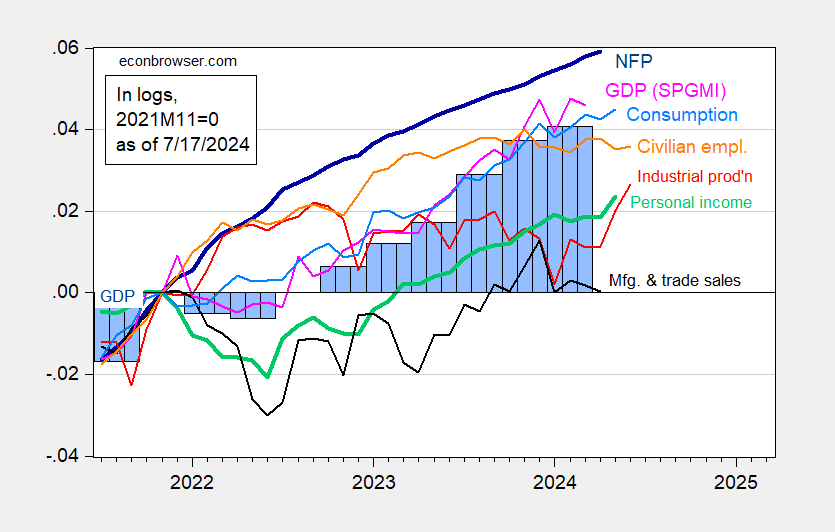

Figure 1: Nonfarm payroll early benchmark (NFP) (bold blue), private employment adjusted using CBO immigration estimates (orange), manufacturing production (red), personal income excluding current transfers for Ch. 2017$ (bold green), manufacturing and trade sales for Ch. 2017$ (black), consumption for Ch. 2017$ (light blue), monthly GDP for Ch. 2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Federal Reserve Bank of PhiladelphiaFederal Reserve through FRED, BEA 2024Q1 3rd Release, S&P Global Market Insights (Former Macroeconomic Advisor, IHS Markit) (7/1/(released in 2024) and author’s calculations.

Note that the Adjusted Civilian Employment series is flat because it assumes that immigration will be consistent with what is incorporated into the BLS series starting in July 2023.

Compare with the NBER BCDC indicator.

Figure 2: CES nonfarm payroll (NFP) employment (bold blue), private sector employment (orange), industrial production (red), personal income excluding current transfers for Ch. 2017$ (bold green), manufacturing and trade sales for Ch. 2017$ (black), consumption for Ch. 2017$ (light blue), monthly GDP for Ch. 2017$ (pink), log GDP (blue bars), all normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 3rd Release, S&P Global Market Insights (Former Macroeconomic Advisor, IHS Markit) (7/1/(released in 2024) and author’s calculations.