In green paper:

Define the perfect economic downturn as accurately predicting all economic downturn and not that the economic downturn is not misleading. Benchmark Spreads (10 -year negative two and 10 years minus three -month spreads, short -term forward spreads) are not perfect and produce up to 59 misunderstandings from 1962 to present. Using a supercomputer, we found 83 perfect spreads by searching for more than 665 million forward and term spreads, which recorded an average of 665 million days across other horizons. Unlike the benchmark spread, the perfect thing tends to start with a four -year move with a one -year moving average. We use the new Keynesian model to rationalize these features of perfect functions and emphasize the fundamental economic mechanism. Finally, we expand the concept of perfect spreads, forming a recession forecast index and showing excellent statistical performance compared to benchmarks.

In this case, the perfect prediction variable means Auroc = 1. At least the obvious questions raised for policy makers are whether the economic downturn is possible. I used the first list of perfect forward spreads.

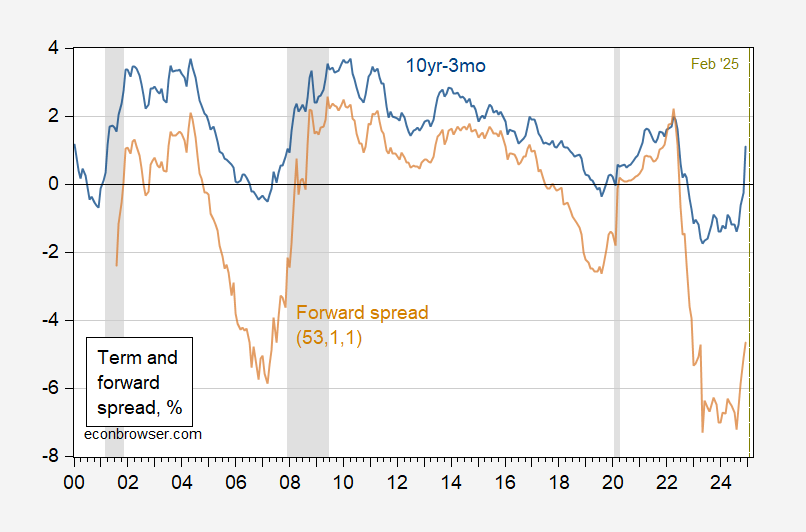

The top forward spread is L = 53, M = 1, n = 1. I use the five -year government bond yield as a maturity (60 months) instead of a 53 -month coupon yield. Then compare this with the 10YR-3MO spread that usually uses.

Figure 1: Figure 1. 10 years and 3 months of government termspreads (blue), forward spreads (brown), %. Source: Calculation of Finance and Author through Fred. Source: Treasury through Fred, NBER.

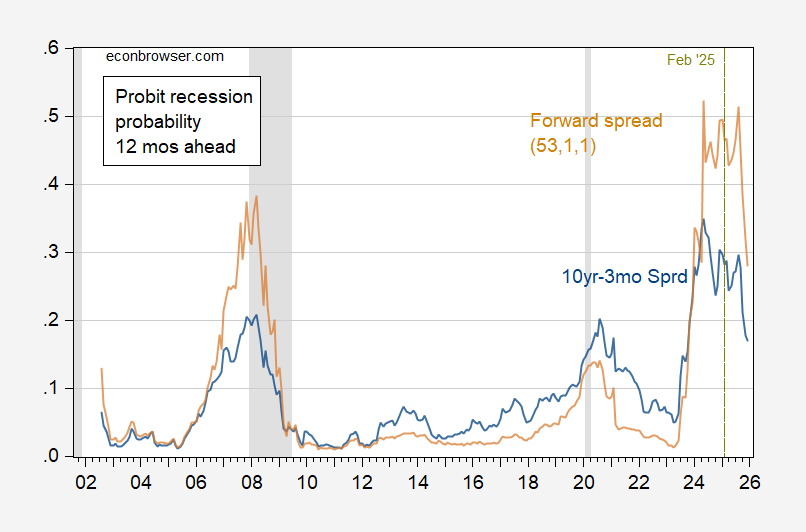

This data will lead to an estimation of this recession in 12 months. (DIERCK et al (2025) estimates the probbat model in a shorter and shorter sample (2001M08-2025M01).

Figure 1: Figure 1. 10 years and 3 months of government terms of government terms (blue), forward spreads (brown) prediction. The NBER has a grade gray shaded date with the defined peak-troph. Source: Calculation of Finance and Author through Fred. Source: Treasury through Fred, NBER.

Needless to say, the recession is still plausible, even if the most recent economic statistics do not represent the economic downturn. According to forward spreads, it is better than the possibility of recession as of February.

Dierck et al. I searched more than millions of combinations related to spreads and forward spreads, but did not consider other variables. Although it is estimated in the same sample, but integrated the debt service ratio, the revised chinn-perrara specifications only generate the economic downturn in January 2025.