CBO released its 10-year outlook today. (The IMF did the same. WEO January Update). Growth continues but is slowing, is slightly less optimistic than the administration and noticeably lower than the IMF and FT-Booth surveys.

Figure 1: Reported GDP (bold black), CBO (tan), administration (light blue square), IMF (pink), FT-Booth survey (red triangle), expert forecaster survey (green line), 1/17 GDPNow (blue + ), all in bn.Ch.2017$ SAAR units. IMF, FT-Booth, GDPNow levels are calculated by iterating the growth rate at the relevant lag level. Source: BEA 2024Q3 3rd release; CBO Budget and Economic Outlook, January 2025, 2025 Presidential Economic Report, IMF WEO January 2025, FT-Booth Macroeconomist SurveyCalculations by Philadelphia Fed, Atlanta Fed, and author.

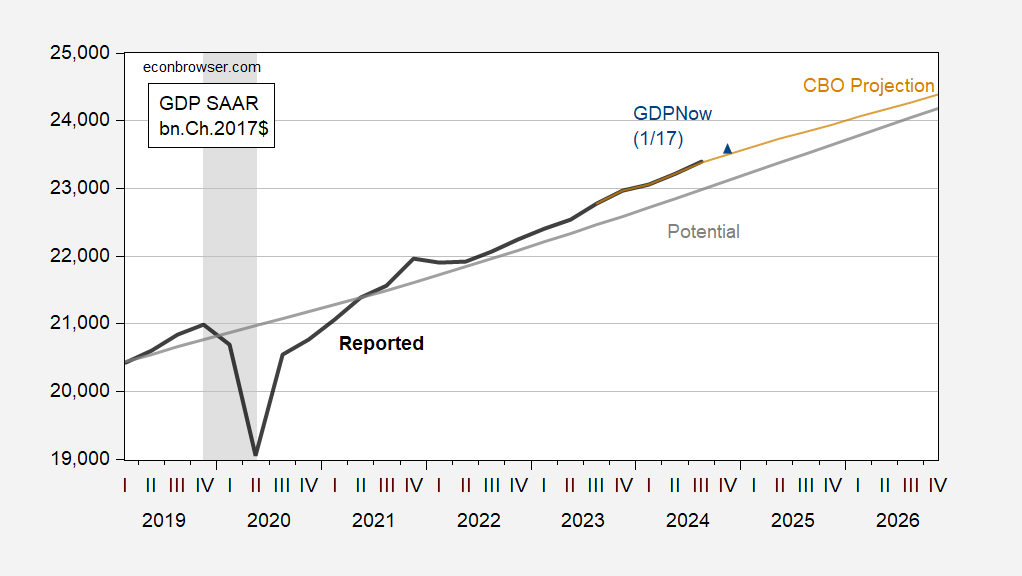

CBO expects the economy to continue growing (using data available as of mid-January under current law) and the output gap is expected to remain positive in future quarters. As of the third quarter of 2024, the output gap using the most recent estimate of potential GDP was 1.8% (log term) (compared to 2.6% using the June 2024 potential GDP vintage). The Atlanta Fed’s current GDP projections call for an output gap of 1% in the fourth quarter of 2024.

The IMF forecast (based on exchange rates from October 22 to November 19) is consistent with the Atlanta Fed’s current outlook, but is much more optimistic for the fourth quarter of 2025. The growth rate for Q4/Q4 2025 is pegged at 2.4% (not significantly different from the FT-Booth interim forecast). ).

Figure 2: Reported GDP (bold black), CBO (tan), CBO’s estimate of potential GDP (gray), and 1/17 current GDP (blue +), all in bn.Ch.2017$ SAAR units. NBER defines recession dates as gray, from peak to trough. The GDPNow level is calculated by iterating the growth rate at the relevant lag level. Source: BEA 2024Q3 3rd release, CBO Budget and Economic Outlook, January 2025Atlanta Fed, NBER, and author’s calculations.