From the IMF (27 September 2024):

Figure 1: USD share of total reported reserves (light blue), with 60% of the share not allocated to USD shares (bold blue). Source: IMF, COFER, author’s calculations.

While this decline may seem steep, it is interesting to note that there was a faster change during the Trump administration. Some context is useful anyway.

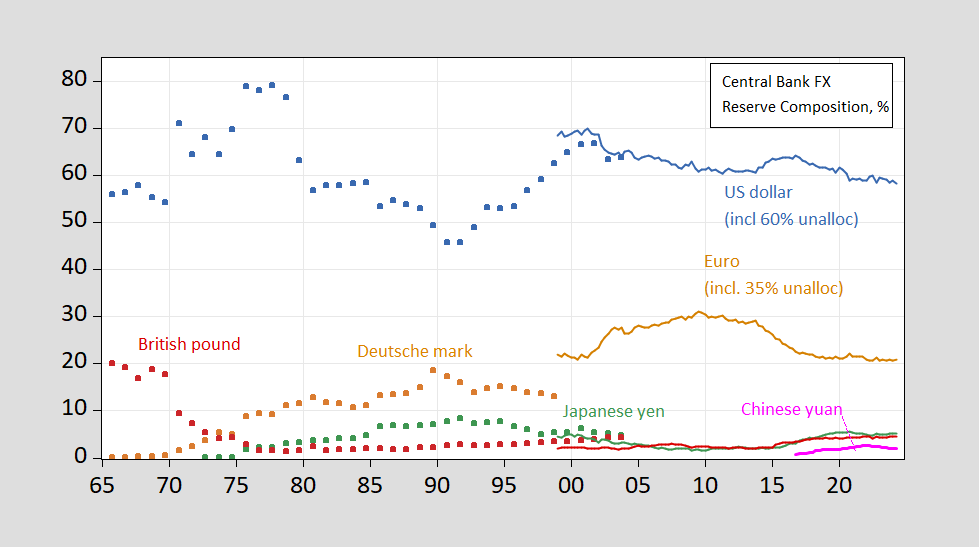

Figure 2: The percentage of foreign exchange reserves held by the central bank, expressed in USD (blue), EUR (orange), DEM (tan square), JPY (green), GBP (light blue), Swiss franc (purple), and CNY (red). For post-1999 data, estimates based on COFER data and allocation of unallocated reserves are described in the text. source: Chin and Frankl (2007)IMF COFER accessed 1 October 2024, authors’ estimates.

The decline in the third quarter of 2022 can be explained by the decline in the value of the US dollar (remember that stocks are calculated using the value of a currency valued using market exchange rates). Therefore, it is somewhat early to worry about the end of the dollar’s reserve currency hegemony.

For more information on holding FX reserves from a central bank perspective, see: Chin et al. (2024)Discussed here.