Michigan consumer sentiment and conference board economic confidence rise. But expectations are low.

Figure 1: University of Michigan consumer sentiment (blue, left scale), Conference Board economic confidence (tan, left scale), and Gallup economic confidence (green, right scale). Source: State of Michigan (see FRED, Conference Board, Gallup)

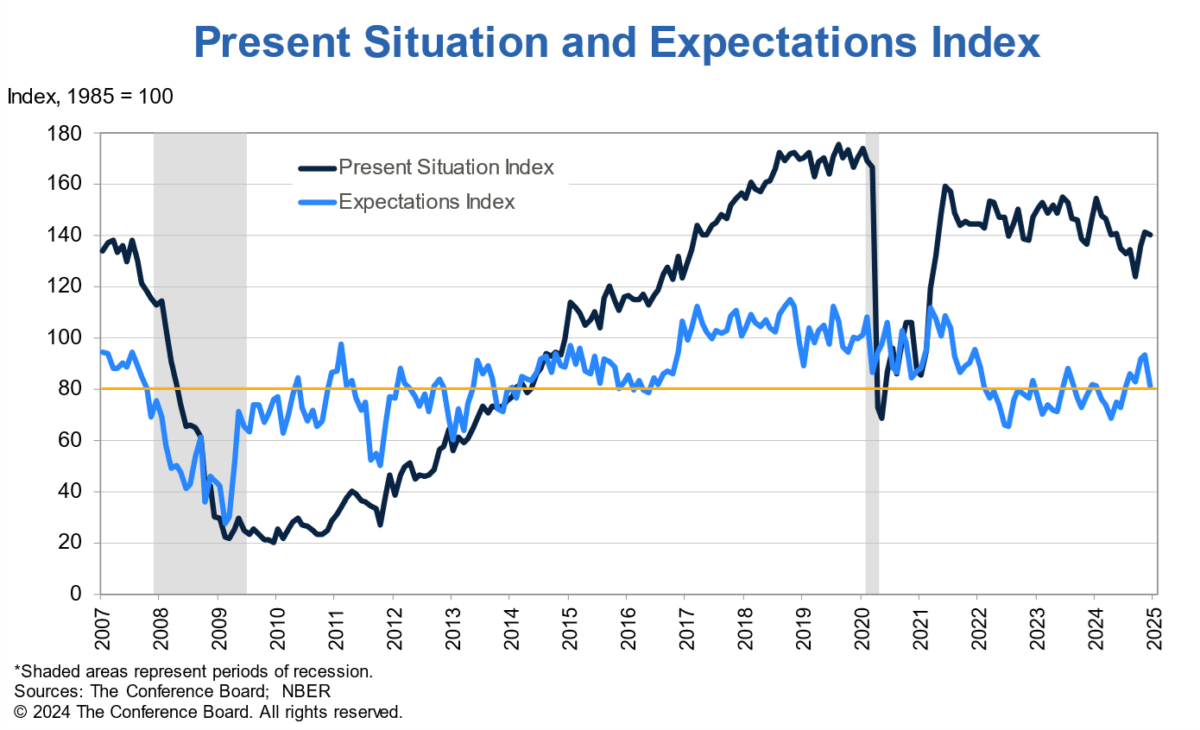

The current situation has risen in part due to the impulse to buy now to avoid future tariffs.

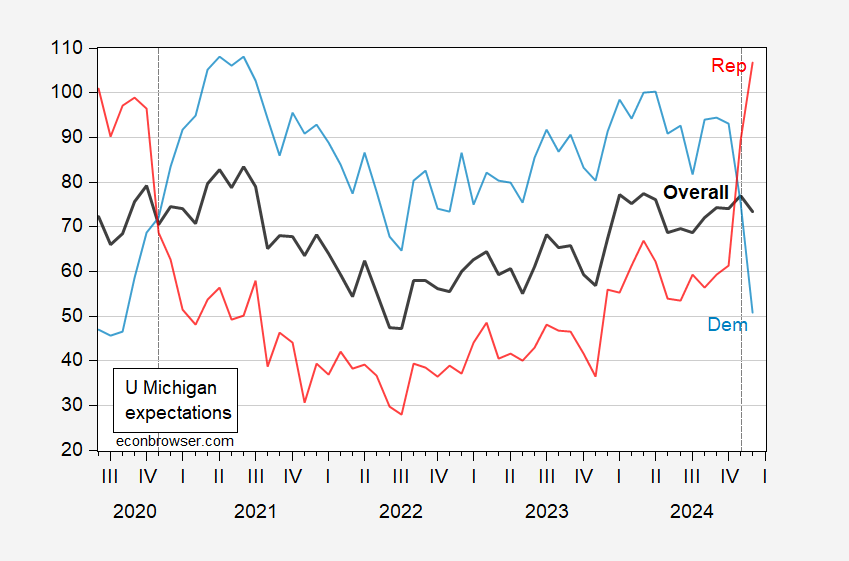

Interestingly, expectations as measured by Michigan have declined due to anxiety about the impact of tariffs. And yet, while Republicans/Lean Republicans have seen their expectations soar, Democrats/Lean Democrats have seen the opposite (in 2020, it was the opposite).

Figure 2: University of Michigan expectations (bold black), expectations for Democrats/leaning Democratic (blue), and expectations for Republicans/hopeful Republicans (red). Source: University of Michigan, FRED.

The Conference Board expectations index also declined.

source: conference board.

The council’s note on the December results includes:

In response to factors influencing consumers’ views on the economy, the following are mentioned: politicsIt continued to rise, including in the wake of the November election. Mention of tariff It also increased in December. Specifically, this month’s special question found that 46% of U.S. consumers expect tariffs to raise the cost of living, while 21% expect tariffs to create more U.S. jobs.

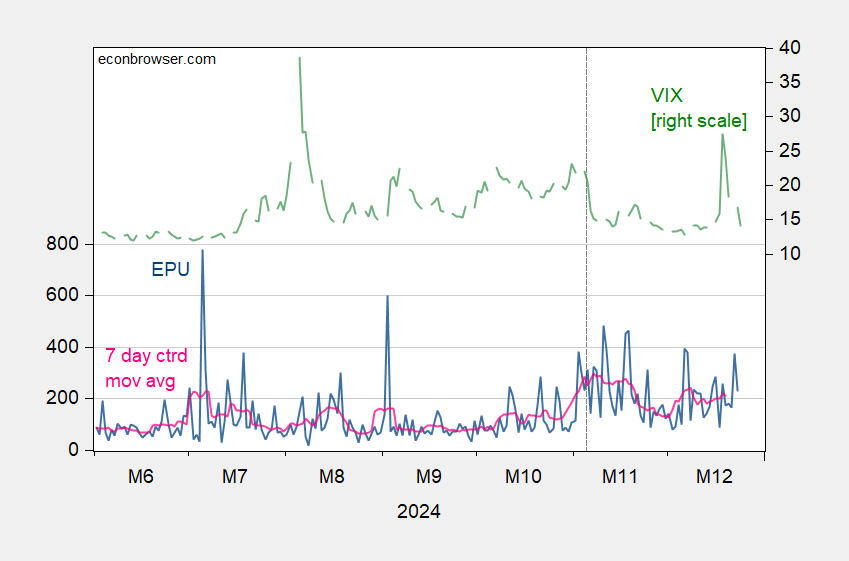

Certainly, uncertainty has increased since the election compared to the recent past.

Figure 3: EPU (blue, left scale), EPU-centered 7-day moving average (pink, left scale), VIX (green, right scale). Source: EPU, CBOE via FRED, author’s calculations.

Now that the people voted for this (well, at least the majority did), let’s get to it…