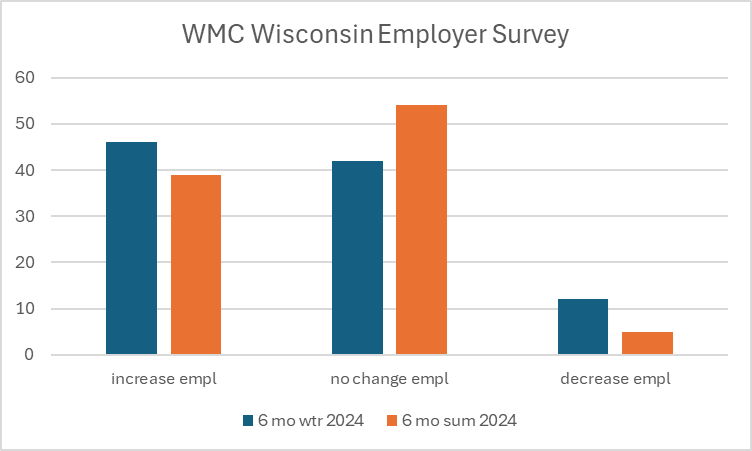

Among the ones just released Summer WMC Wisconsin Employer Survey:

“There is no doubt that the combination of higher costs and higher interest rates is causing employers to rethink their investment and hiring plans,” Bauer added. “While we may not be in a recession as typically defined, these data suggest that the economy could be in a recession at least through the end of the year.”

Well, views on the Wisconsin economy have barely changed since the winter survey.

source: WMC. Note: n=180, 182, winter and summer, respectively. Survey respondents are WMC members.

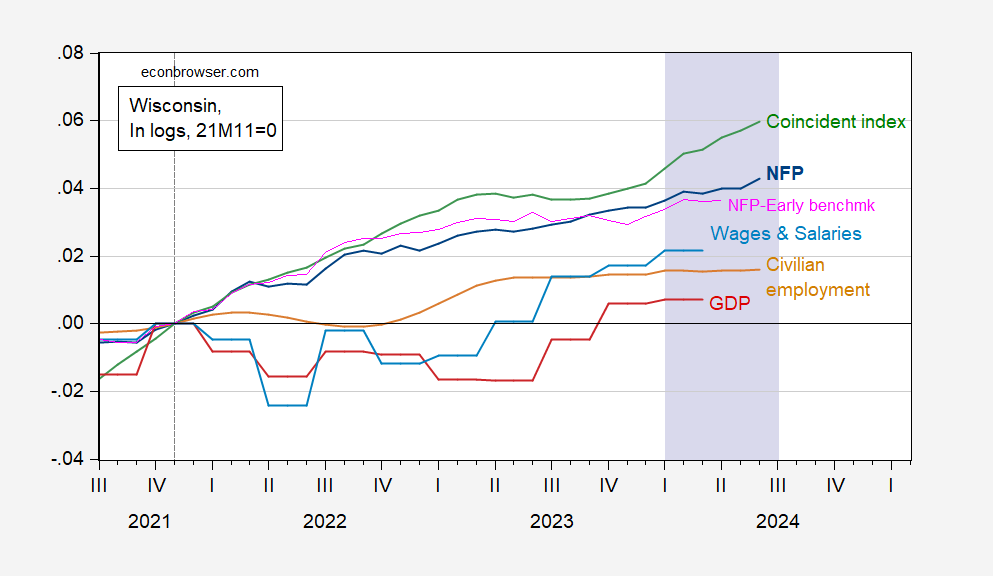

What do objective indicators of the Wisconsin economy show over the six months since the winter survey (released January 17) (lilac shaded in Figure 1 below)?

Figure 1: Wisconsin Nonfarm Payrolls (dark blue), Philadelphia Fed NFP Early Benchmark Measure (pink), Civilian Employment (brown), Real Wages and Payrolls Deflated by National Chained CPI (light blue), GDP (red), Coincident Index (green), all 2021M11=0 log. Lilac shading indicates 6 months after WMC Winter Survey. Source: BLS, BEA, Philadelphia Fed [1], [2]And the author’s calculations.

Nonfarm payrolls, real wages and salaries, and the coincident index all rose over the period. Only private employment, which is not particularly well measured at the state level, was flat. So, cognitive dissonance part 1.

Despite the poor growth outlook that WMC members are seeing, what do you think companies will do in terms of hiring? Surprisingly, they seem to be seeing a growing labor force! Hence, my cognitive dissonance, part 2.

source: WMC. Note: n=180, 182, winter and summer, respectively. Survey respondents are WMC members.

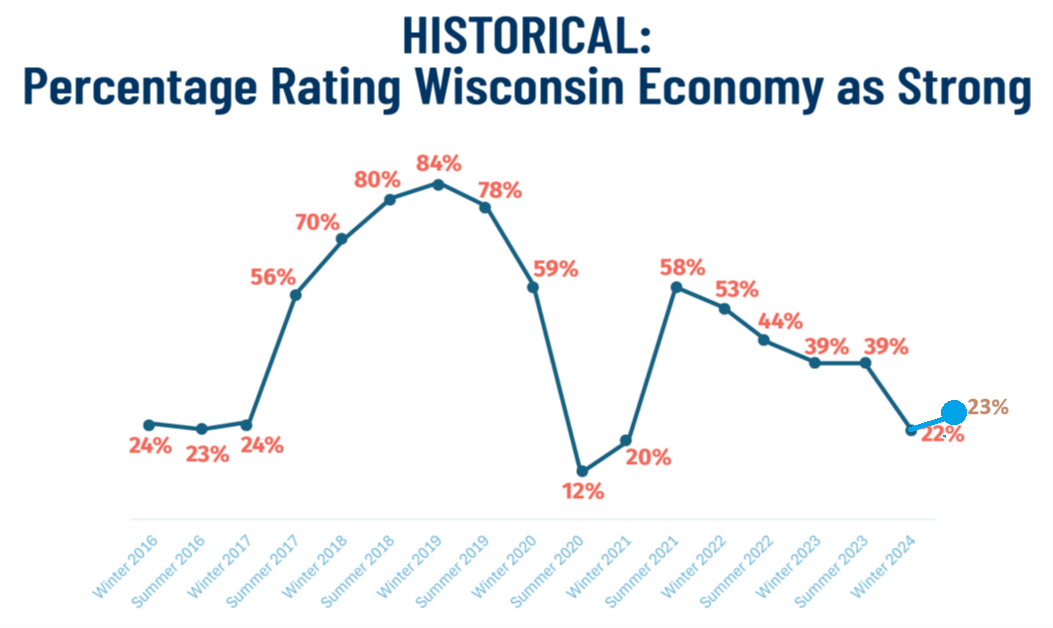

One interesting aspect of the Summer 2024 report is that it omits the time series graph showing the percentage of respondents who rated Wisconsin’s economy as included in the Winter 2024 report. This is probably because the graph did not fit the WMC narrative. To complete the picture, I am including an edited version of the Winter 2024 graph.

memo: The large blue circle is an observation from the summer of 2024. source: WMC, Wisconsin Employer Survey (January 2024)This content was edited by the author using a survey conducted in July 2024.