The survey indicates moderate growth (q4/q4) of 2.0%, not far from the June SEP of 2.1% (unchanged from March).

Figure 1: GDP (bold black), May Professional Forecast Survey median (blue), FT-Booth School implication (tan square), Economic Outlook Survey/FOMC June median implication (light green x), June 7 GDPNow implication ( light blue square) ), all in bn.Ch.2017$ SAAR units. Source: BEA 2024Q1 2nd release; Philadelphia Fed, Booth School Survey, Federal Reserve Board, Atlanta FedAnd the author’s calculations.

The median is 2.0% in Q4/Q4 2024, while the 10th/90th percentile range is 1.8%-2.7%. I was significantly more depressed, with a median of 1.8% (0.8% to 2.5%). The central tendency of the SEP (bottom and top 3 removed) is 1.9%-2.3%, and the range (all responses) is 1.4%-2.7%.

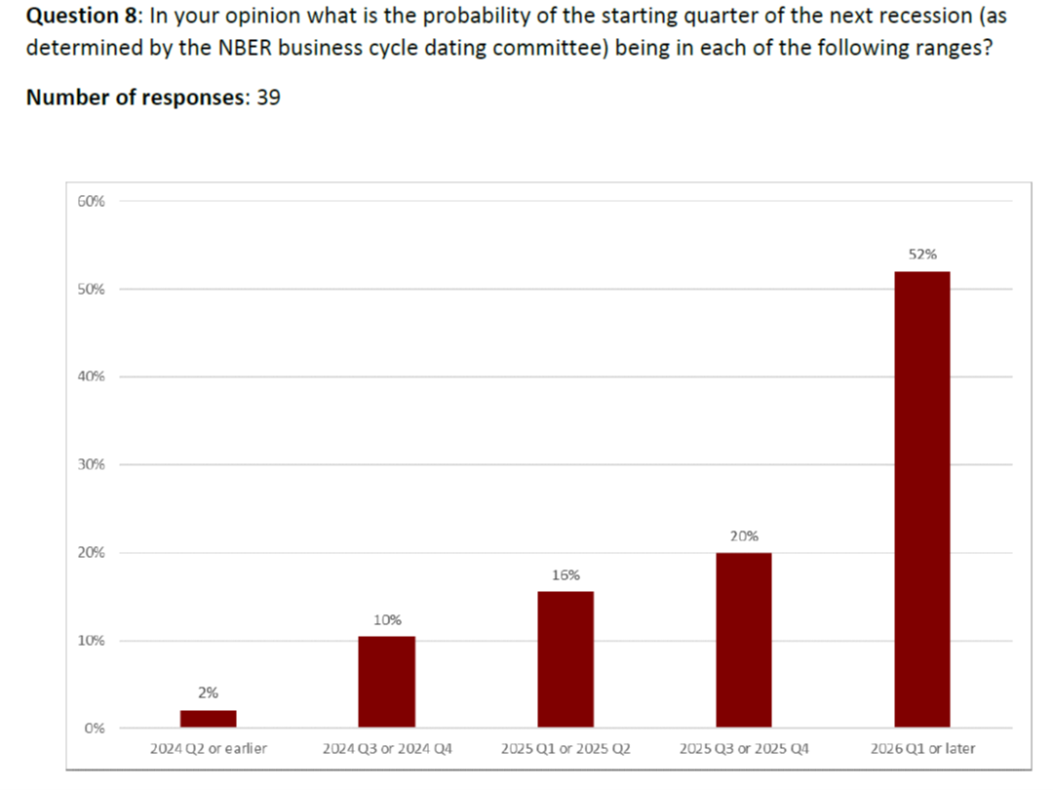

The modal response for the onset of a recession is now after the first quarter of 2026 compared to March (see here).

source: FT-Booth School Survey (June 2024).

The probability of a recession starting in 2024 fell from 18% in March to 12% in May, while the modal forecast for the first quarter of 2026 and beyond increased from 46% to 52%. Again, the short term is a bit more gloomy, with a 40% probability for 2024, reflecting the impact of term spreads (but keeping debt service ratios in mind).

FT article here.