Summary of weekly figures for Lewis/Mertens/Stock and Baumeister/Leiva-Leon/Sims with Torsten Slok.

Figure 1: Lewis/Mertens/Stock Weekly Economic Index (blue) and Baumeister/Leiva-Leon/Sims Weekly Economic Conditions Index (US) plus 2% trend (brown), all y/y growth rates are %. Source: NY Fed via Fred, WECIAccessed 10 August 2024 and calculated by the author.

Both indicators are showing growth rates that are in line with the trend.

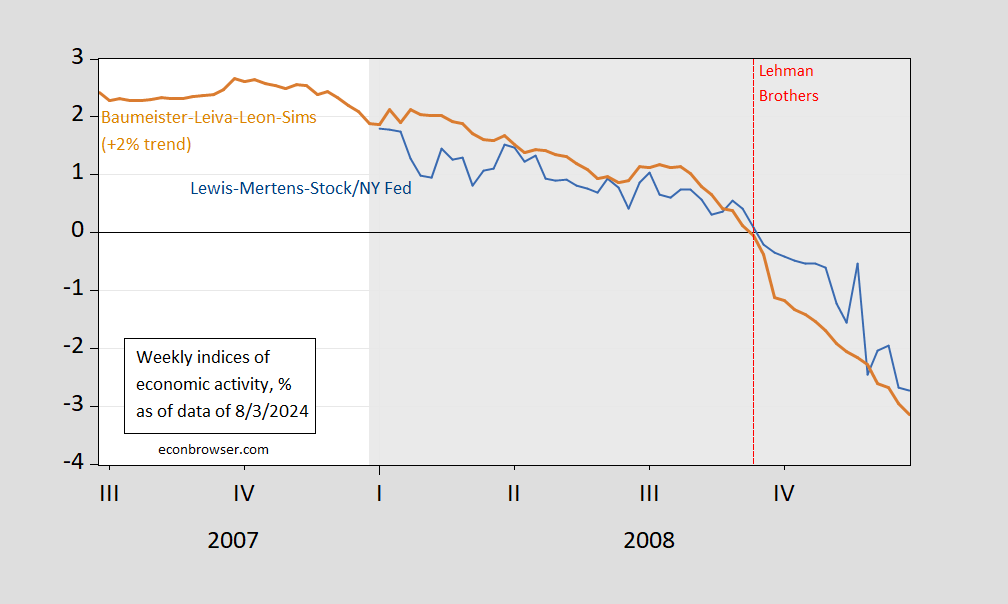

What did these series look like during the period surrounding the 2008 recession (keep in mind this is vintage and not a real-time version):

Figure 2: Lewis/Mertens/Stock Weekly Economic Index (blue) and Baumeister/Leiva-Leon/Sims Weekly Economic Conditions Index (US) plus 2% trend (brown), all y/y growth rates are %. Source: NY Fed via Fred, WECIAccessed 10 August 2024 and calculated by the author.

So, based on the data available as of August 3, the recession doesn’t look that serious.

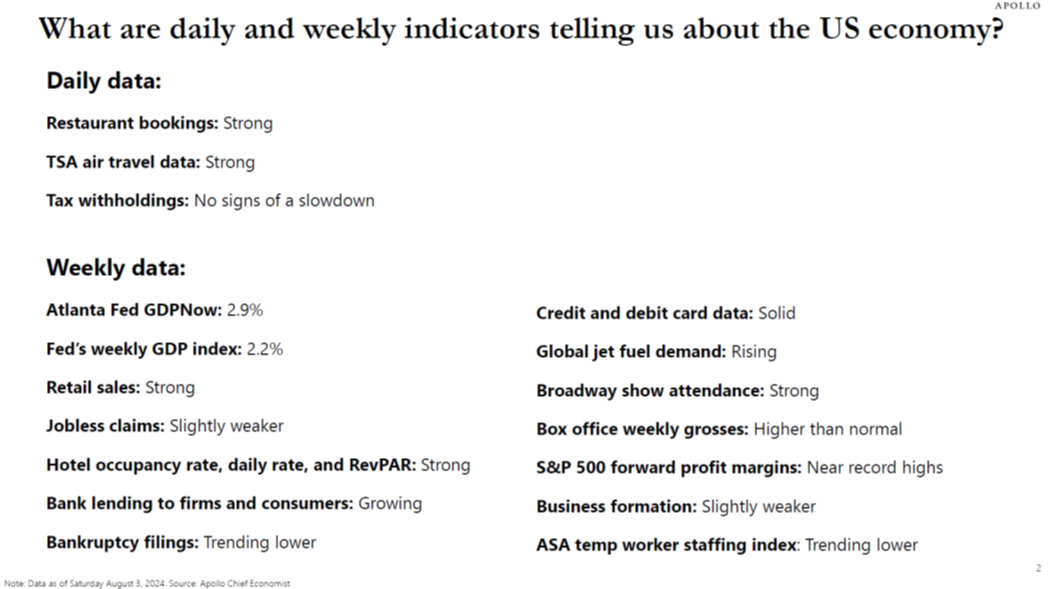

As promised, here is a summary of daily and weekly indicators from Torsten’s US Economic Chartbook, published today.