Artificial intelligence (AI) enthusiasm has played a major role in driving the market higher so far this year. Nvidia and Microsoft With massive buying activity being witnessed, many investors are looking at lesser-known options in search of the next big AI opportunity.

One such company that has experienced its share of hype is: Super Micro Computers (NASDAQ: SMCI)Shares of AI-loved companies rose 234% last year and are expected to rise 218% by 2024.

Supermicro has a close partnership with Nvidia, but the underlying business is actually quite different and, in my opinion, much less profitable.

Let’s take a look at Supermicro’s investment outlook and see if this stock is worth adding to your portfolio.

Supermicro’s business is growing rapidly, but…

Perhaps the hottest area in the AI space is semiconductor. The demand for graphics processing units is skyrocketing.Graphics cards) As generative AI applications continue to evolve.

Now Nvidia SDHD Co., Ltd., IntelAnd several other chip designers have emerged as big names in the GPU market. Supermicro partners with many chip companies, but it is not a semiconductor company per se.

Rather, Supermicro specializes in IT infrastructure. The company primarily designs architectural solutions, such as storage clusters for high-performance GPUs.

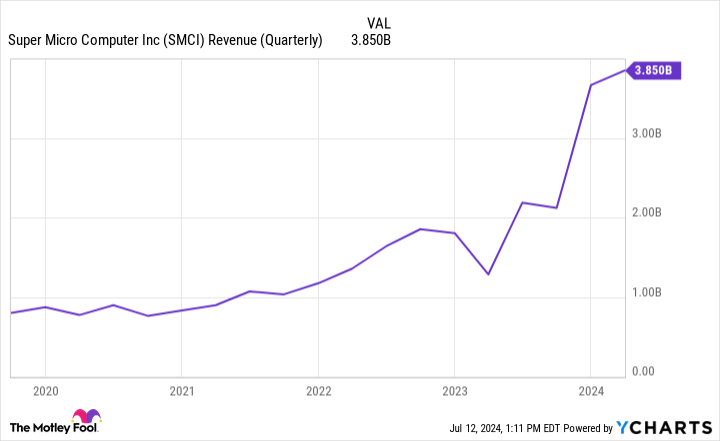

The sales trends shown below show that increased demand and purchasing activity surrounding chips has acted as a weather vane for Supermicro’s services over the past few years.

While the newfound revenue growth is encouraging, investors should be aware of some low points regarding Supermicro.

…there’s more than meets the eye

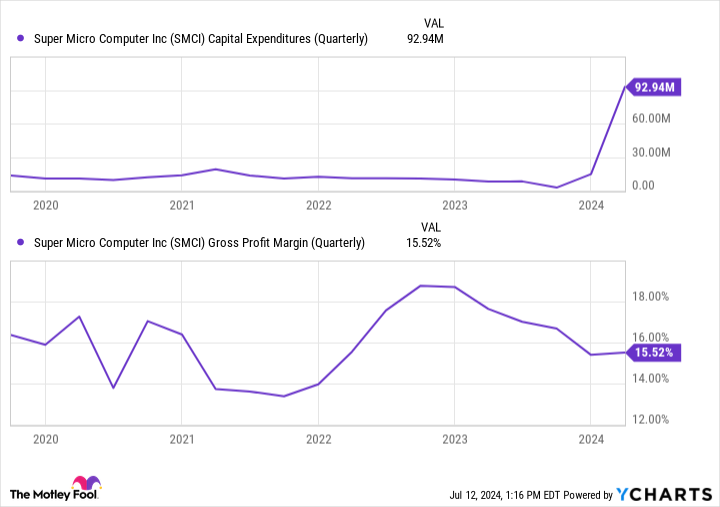

While the growing demand may be a good thing for Supermicro, it is important to keep in mind that building IT infrastructure is a costly business.

Look at the dynamics in the chart below. Supermicro’s capital expenditures (capex) have been skyrocketing in recent quarters. The idea I’m trying to convey here is that while the company’s revenues are skyrocketing, its expenses are also increasing significantly.

These dynamics have a direct impact on Supermicro’s margin profile. As observed below, Supermicro’s gross margins are actually peaking at the moment.

Of course, the financials analyzed above aren’t necessarily a reason to run away to the mountains, but there are a few other potential issues that should be explored with Supermicro.

Keep in mind that semiconductors are a cyclical industry. Right now, the chip business is enjoying a bit of a renaissance thanks to the AI craze. But like any other type of business, supply and demand trends will eventually normalize.

This could spell trouble for Supermicro in the long run. It is very difficult to predict demand for any product, especially cutting-edge chips used in groundbreaking AI applications. This topic raises concerns that Supermicro’s business could slow down. This could have a bigger impact on the company’s profitability profile, which would be a welcome surprise given the already low margin nature of the business.

Is now a good time to buy Supermicro stock?

Many investors have undoubtedly made a lot of money by owning Supermicro stock, but I am skeptical that the gains were made for the right reasons. I suspect that many investors viewed Supermicro as being similar to Nvidia and invested in the stock accordingly. Therefore, when Nvidia and other chip stocks began to rise, Supermicro’s stock followed suit.

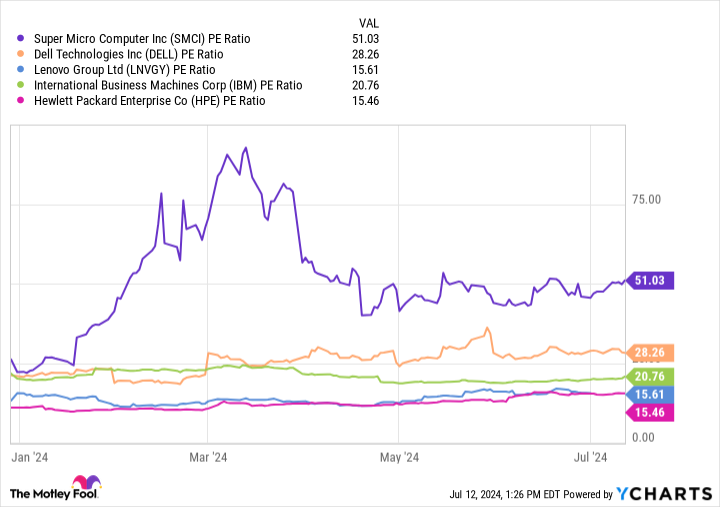

The chart above is a benchmark comparing Supermicro to its peers based on P/E (Price to Earnings Ratio). The obvious takeaway from the valuation above is that Supermicro is valued at a significant premium over its peers.

But a more subtle argument is made by companies like: Dell Technologies and International Business Machine Not only is it much larger than Supermicro, but it is also much more diverse in its products and services. Yet Supermicro’s P/E is more than double that of IBM and much higher than that of Dell.

Taking into account the broader level of competition and cyclicality in the chip space, combined with the high capital expenditures and low margin nature of Supermicro’s business, I cannot help but think the stock is overvalued.

I think investors with a long-term perspective have a better chance overall in the chip space and AI. While it may seem tempting to buy Supermicro stock, I see the company more as a deal than an investment.

Should you invest $1,000 in Supermicro Computers right now?

Before buying Super Micro Computer stock, consider the following:

that much Motley Fool Stock Advisor The analyst team just confirmed what they believed. Top 10 Stocks Investors should buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the coming years.

When do you consider it? Nvidia We compiled this list on April 15, 2005… If you had invested $1,000 at the time of our recommendations, You will have $791,929!*

stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on portfolio construction, regular analyst updates, and two new stock recommendations each month. stock advisor There is a service Increased by more than 4 times The recovery of the S&P 500 since 2002*.

*Stock Advisor returns returns as of July 8, 2024.

Adam Spataco We have positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long the January 2025 $45 call on Intel, long the January 2026 $395 call on Microsoft, short the August 2024 $35 call on Intel, and short the January 2026 $405 call on Microsoft. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. Public Policy.

Is it a good time to buy Super Micro Computer stock now? Originally published by The Motley Fool.