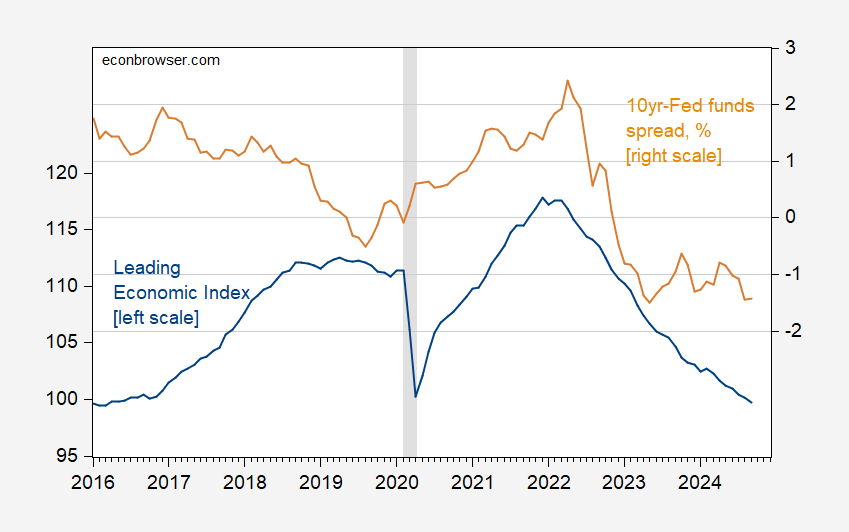

The ‘Regressive Camp’ member list has been updated. Assuming there is no recession (listen. Cam Harvey talks about this.), what can we gain from this? Conference Board’s Leading Economic Index Back in recession territory (where I’ve spent most of the last 18 months):

The first thing to note is that the LEI (like many financial condition indices) includes some form of term spread. So when the LEI falls, some of it (I don’t know exactly how much) is due to changes in term spreads.

Figure 1: Conference Board Leading Economic Index (blue, left scale) and 10-year Fed funds spread, % (tan, right scale). NBER defines recession dates as gray, from peak to trough. Sources: Conference Board via TradingEconomics.com, U.S. Treasury, Federal Reserve via FRED, NBER.

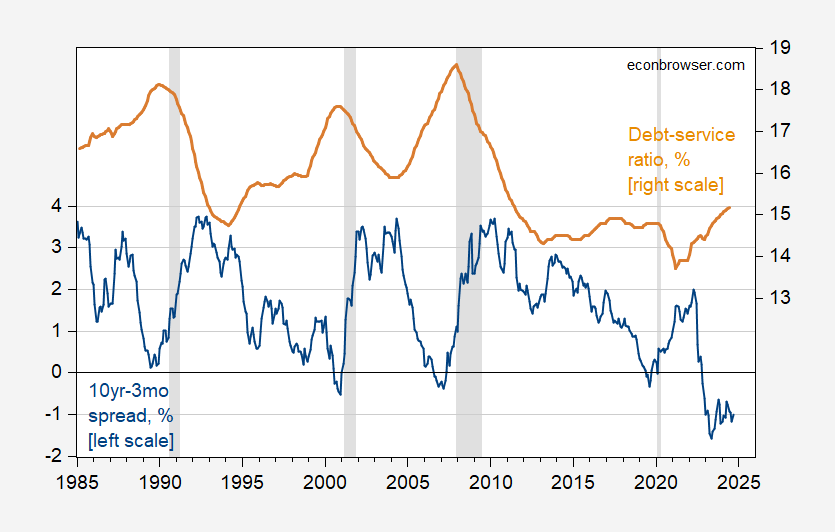

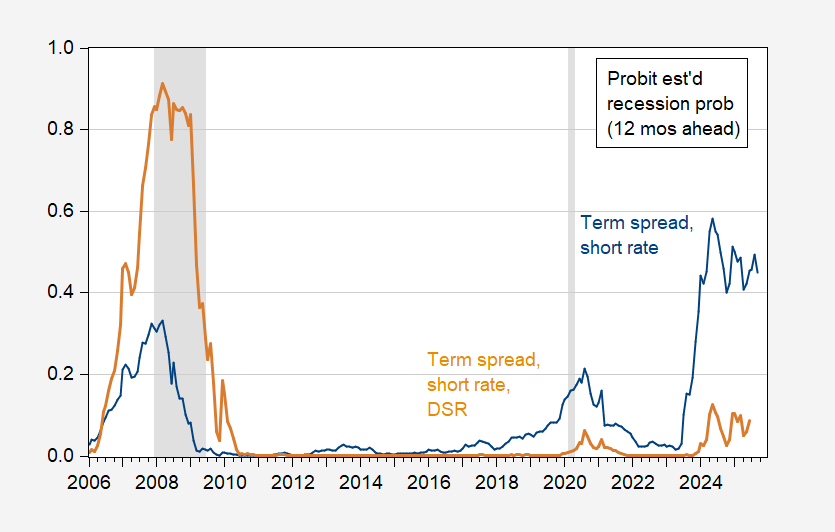

Herein lies the relevance of this point. Looking at the term spread (3-month interest rate, not the federal funds rate), the probability in October was 40%, and the probability in May was 58%. So either historical correlations will break down or a recession is coming soon (or it’s already and we just don’t know it). Perhaps important variables have been omitted. sugar Chin and Ferrara (2024)We argue for a private non-financial sector debt service ratio.

Figure 2: 10-Year-3-Month Treasury Term Spread (blue, left scale) and Private Non-Financial Sector Debt Service Ratio (tan, right scale), both in %. The 2024Q2 debt service ratio was estimated using the lagged value of the change in the debt service ratio, the 3-month Treasury yield, and the AAA interest rate. DSRs were interpolated from quarterly to monthly using linear interpolation. NBER defines recession dates as gray, from peak to trough. Source: Treasury via FRED, BIS, NBER.

Interestingly, debt service has been relatively low compared to previous recessions.

The Term Spread – Debt Service Expansion model (see this post) is a much better fit for the 2008-09 recession, even though a recession is much less likely.

Figure 3: Probit regressions for term spreads and short-term interest rates (1986-2024 (blue)), and 12-month-ahead recession probability estimates for term spreads, short-term rates, and debt service ratios (tan). NBER defines recession dates as gray, from peak to trough. Source: Treasury with FRED, BIS, NBER and author’s calculations.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25698180/10332_Leica_M_Edition_70_hero_HiRes.jpg?w=150&resize=150,150&ssl=1)