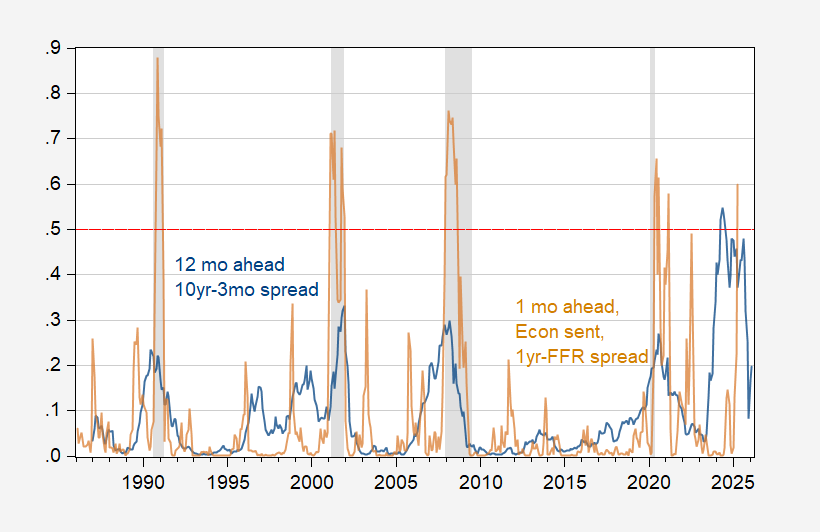

I executed the professional comb regression of the NBER Peak-Trope recession in the Fred Variable Umcsent (final reading in March) and the last year. Miller (2019) This spread shows that it has the highest spread a month a month.)

Pseudo-R2 is quite high, but it is expected to carry out the recession for the competition.

And as of February 2025, there is a probability that the estimated economic downturn has expanded to 2025m03, assuming that the recession did not occur.

Figure 2: Figure 2. Y/Y changes in the microscopic consumer sentiment and the probability of economic downturn a month before the one -year financial fund spread. As of March 28, it spreads in March based on the final reading and yield/rate. The NBER has a grade gray shaded date with the defined peak-troph. Horizontal red dotted line at 50% threshold. Source: U.MICHIGAN, Treasury, Federal Reserve, NBER and Author Calculation.

The possibility of April is 60%(the final U.MICHIGAN reading and interest rate by 28th). If you use a 50% threshold, there is no oh detection (45% is used in 2022.

The decision factor makes you understand why the possibility of the estimated recession is high.

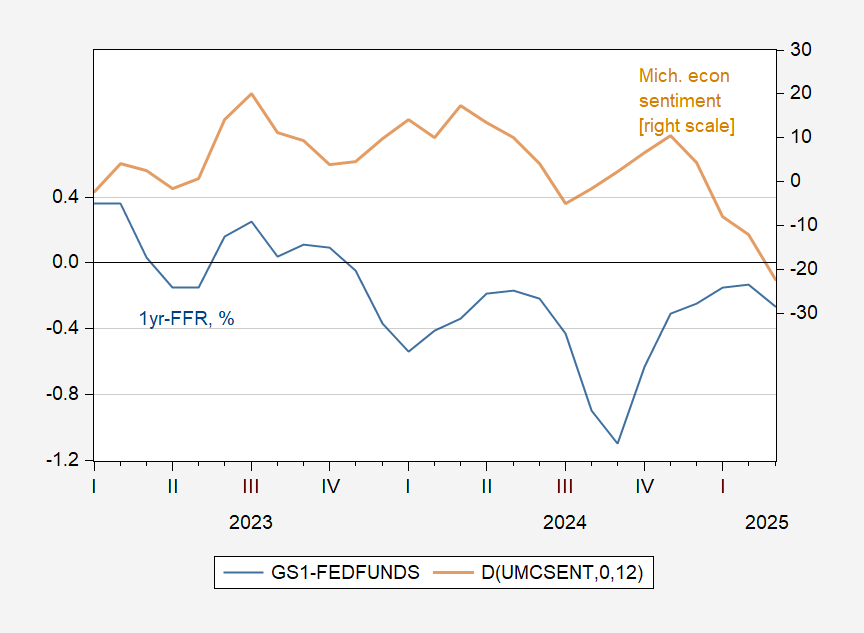

Figure 2: Figure 2. One-year Treasury-Fed funding, % (blue, left scale) and U.MICHIGAN Economic sentiments (brown, right) year-on-year. Source: Calculation of Fred, U.Michigan and the author.

The 1YR-FFR spread has deepened, and the microscopic index has experienced a big and fast reduction.

In other words, there were few signs of recession in simultaneous-hard data indicators.