Torsten Asmus

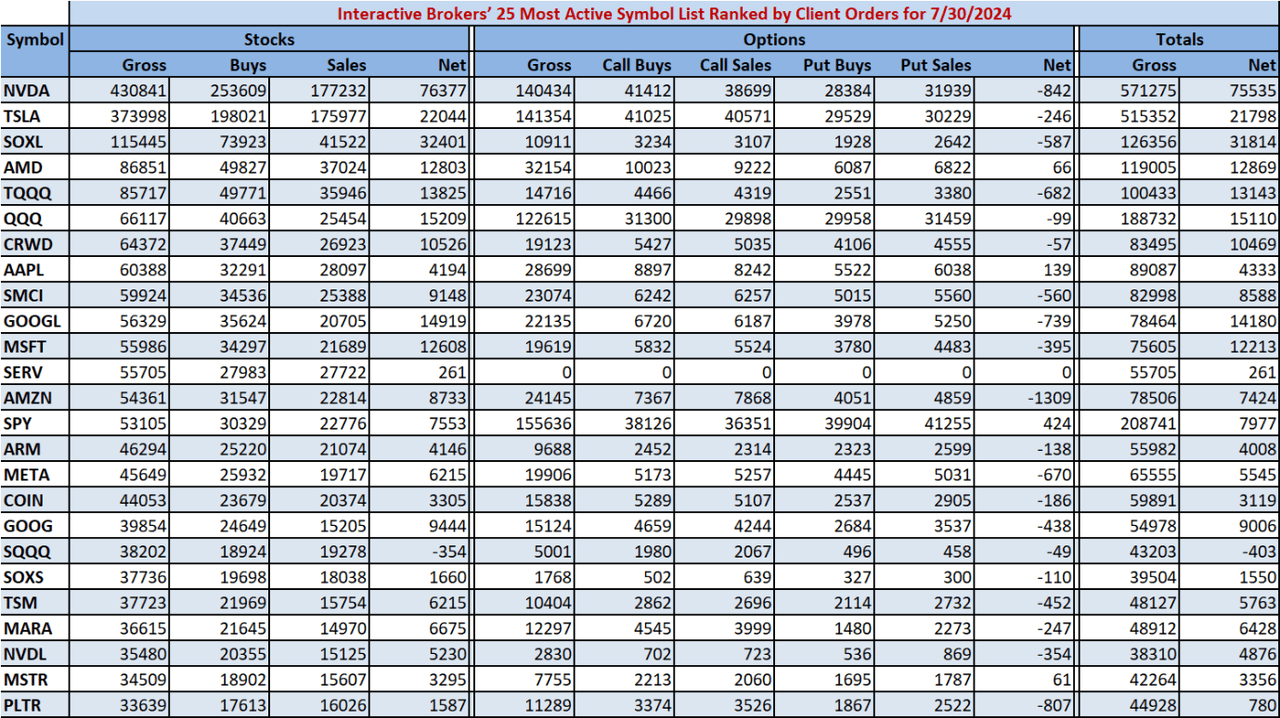

A weekly list of the most active symbols on Interactive Brokers’ (IBKR) trading platform revealed “notable” net share-buying activity in Nvidia (NVDA) and other technology stocks despite the sector’s continued sell-off.

The chip giant, led by Jensen Huang, claimed: While electric car maker Tesla topped the updated list for the second week in a row,TSLA) took second place.

The Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL), which tracks the performance of the NYSE Semiconductor Index, Advanced Micro Devices (AMD) and the ProShares UltraPro QQQ ETF (TQQQ) round out the top five.

The Consumer Price Index report for June on July 11 led to a massive rotation in tech stocks, with Nvidia (NVDA) down more than 12% by the close. Meanwhile, on Wall Street, the tech-heavy Nasdaq Composite (COMP:IND) fell 5% over the same period, while the Nasdaq 100 (NDX) fell 5.7%.

“Our clients have been a loyal bunch this past week. This list is very similar to the last letter we sent. Frankly, it’s not that remarkable that this list continues to be led by NVDA and TSLA. But the net buying activity, especially NVDA, which hit a two-month low, is notable. All of the stocks were net sellers, sometimes quite large,” Steve Sosnick, chief strategist at IBKR, said Tuesday.

CrowdStrike (CRWD) has dropped from third to seventh place on the updated list of most active symbols, with the cybersecurity company continuing to gain traction following the historic global IT outage on July 19.

“CRWD appears to be the victim of a more persistent problem, hitting a new post-crisis low this morning. It fell from third to seventh last week, but at least it did so amid light net buying activity,” Sosnick said.

“The impulse to buy the dip seems to be deeply ingrained in the mindset of active traders. To be fair, it has been a largely foolproof strategy over the past few years, at least when it comes to high-momentum, technology-focused stocks and indices.”

“But there is a risk that even a small, sudden change could lead to a prolonged selloff. It’s too early to know where mega-cap tech gains and central bank decisions will lead this week, but for better or worse, we know what our clients expect,” IBKR’s Sosnick added.

See below for complete data on the IBKR 25 most active lists.