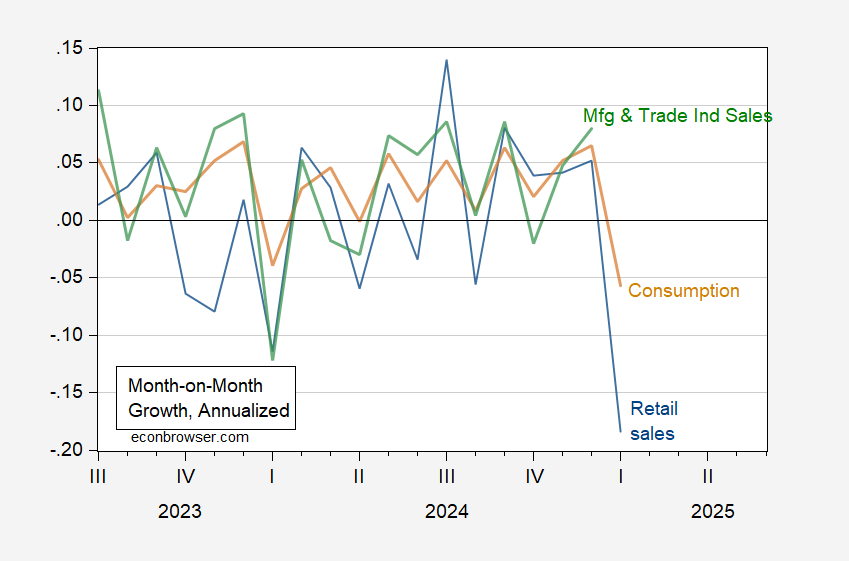

NBER Business Cycle Date Committee Main Indicators. Consumption (preliminary) falls significantly.

Figure 1: Figure 1. Bold Blue’s benchmark revision employment, and in December (blue), the preliminary benchmarks, apocalyptic NFP, reported (orange), industrial production (RED), CH.2017 $ (Bold Light Green) Including personal income except income, $ 20 (BLACK) and 17 $ (BLACK) and 17 $ (BLACK), and CH.2017 $ (BLACK) and personal income, including personal income, including personal income. CH.2017 $ (Pink), GDP (Blue Bars), all logs are normalized at 2021m11 = 0. Source: Fred, Federal Reserve, BEA 2024Q4 BLS through Advance Release S & P Global Market Insight (Nee macro economic advisor, IHS Markit) (2/3/2025 release) and the calculation of the author.

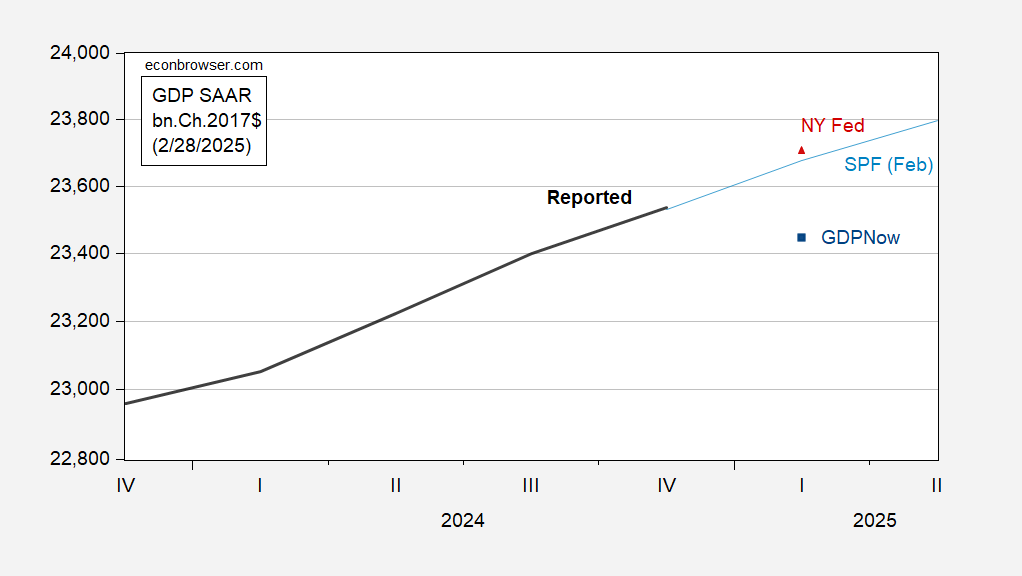

GDPNOW drops rapidly -1.4% Q/Q annually.

Figure 2: Figure 2. 2/28 (Red Triangle) of GDP (BOLD BLACK), Professional Forecorter Survey (TEAL), 2/28 (Blue Square), and NY Fed NowCast. Source: Bea, Philadelphia Fed, Atlanta Fed, NY Fed and Author’s Calculation.

The cliff refers to this picture.

Figure 3: Retail sales are biased by chain CPI (BLUE), actual consumption (TAN), actual manufacturing and trade industry sales (green), and annual monthly growth rate (log difference) annually. Source: BEA, Census, St. Lewis feeds through Fred and calculates the author’s calculation.