Peter Schiff today:

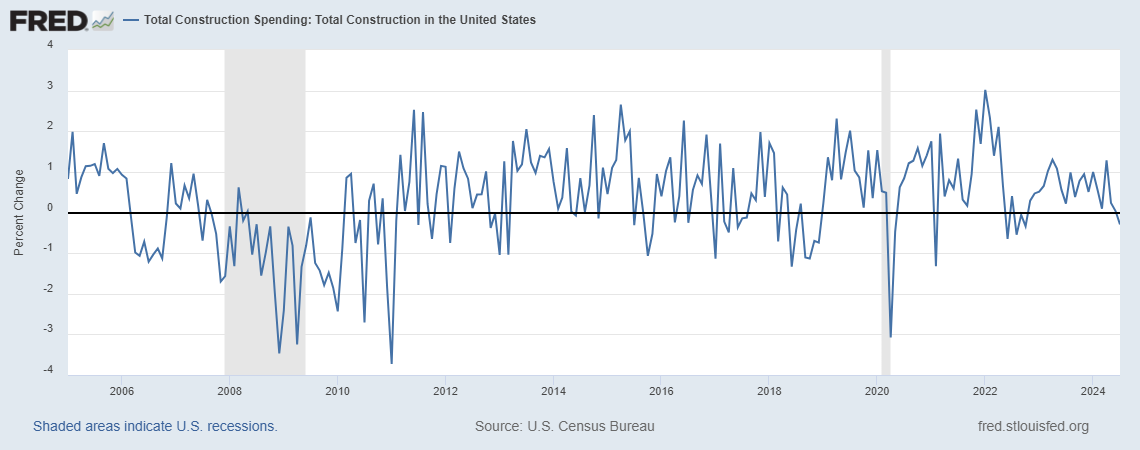

This morning we had three weak economic data reports: the August PMI and ISM manufacturing both came in weaker than expected, and construction spending unexpectedly declined in July. #economy is entering #recession likewise #inflation It is expected to rise further.

Bloomberg reported that the manufacturing PMI was 47.9 vs. consensus 48, and the ISM manufacturing was 47.2 vs. consensus 47.5. The standard deviation of the forecast error over the past year is 0.5, so a surprise of -0.3 is not statistically significantly different from the average surprise of 0.17. Construction spending fell 0.3% m/m vs. consensus +0.1%. The standard deviation of the error is 0.4 ppts, so again the decline is within 1 standard deviation and not statistically significantly different from 0.

As for construction spending:

Goldman Sachs commentary:

. Nominal construction spending fell 0.3% in July (mom sa), against expectations of a 0.1% increase. The spending growth rate was revised up from June (flat from +0.3pp) and May (+0.2% from +0.6pp). Private construction spending fell 0.4% in July, with both private residential spending (-0.4%) and private nonresidential spending (-0.4%) declining. Public construction spending rose slightly in July (+0.1%). This reflects an increase in public nonresidential spending (+0.2%) but a decrease in public residential spending (-2.6%). Construction spending rose 0.6% in July (mom sa, census tract), reflecting a real 0.9% decrease in construction spending.

A recession may be coming. It is not clear whether this announcement is convincing. Note: Mr. Schiff has been predicting recessions. From November 2023.