More articles on dollar dominance, e.g.: foreign policy, Wells Fargobig. Bitcoin News. However, most of the discussion focuses on the use of the dollar as a medium of exchange (SWIFT usage, issuing invoices). Here, we will look at recent trends in the reserve dimension.

Here are some pictures of the major reserve currencies held by BRICS:

Figure 1: USD foreign exchange reserves by central bank. Source: Ito-McCauley database,.

Here are my EUR holdings. Note the change in size.

Figure 2: EUR foreign exchange holdings by central bank. Source: Ito-McCauley database,.

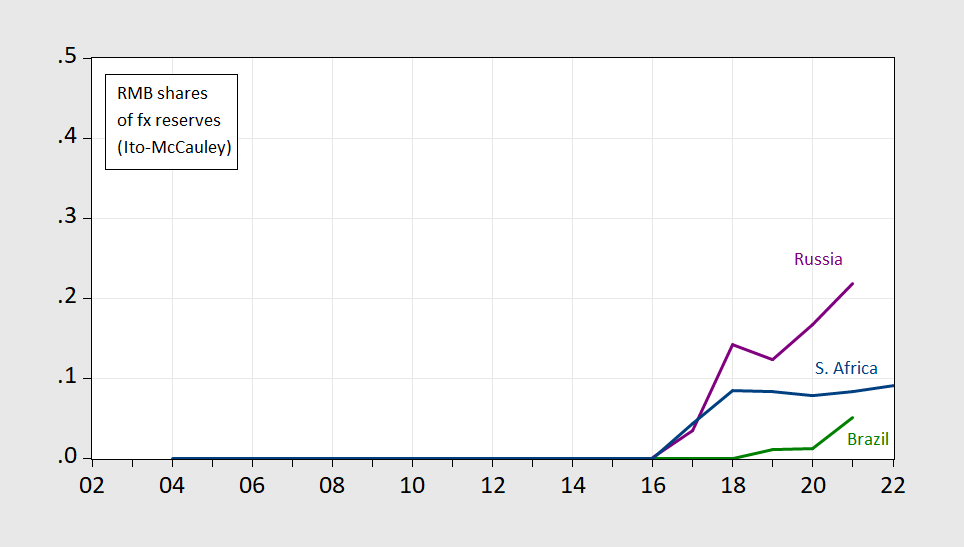

USD reserves have only seen a sharp decline in Russia. What about RMB? We have very limited information here.

Figure 3: RMB foreign exchange reserves by central bank. Source: Ito-McCauley database,.

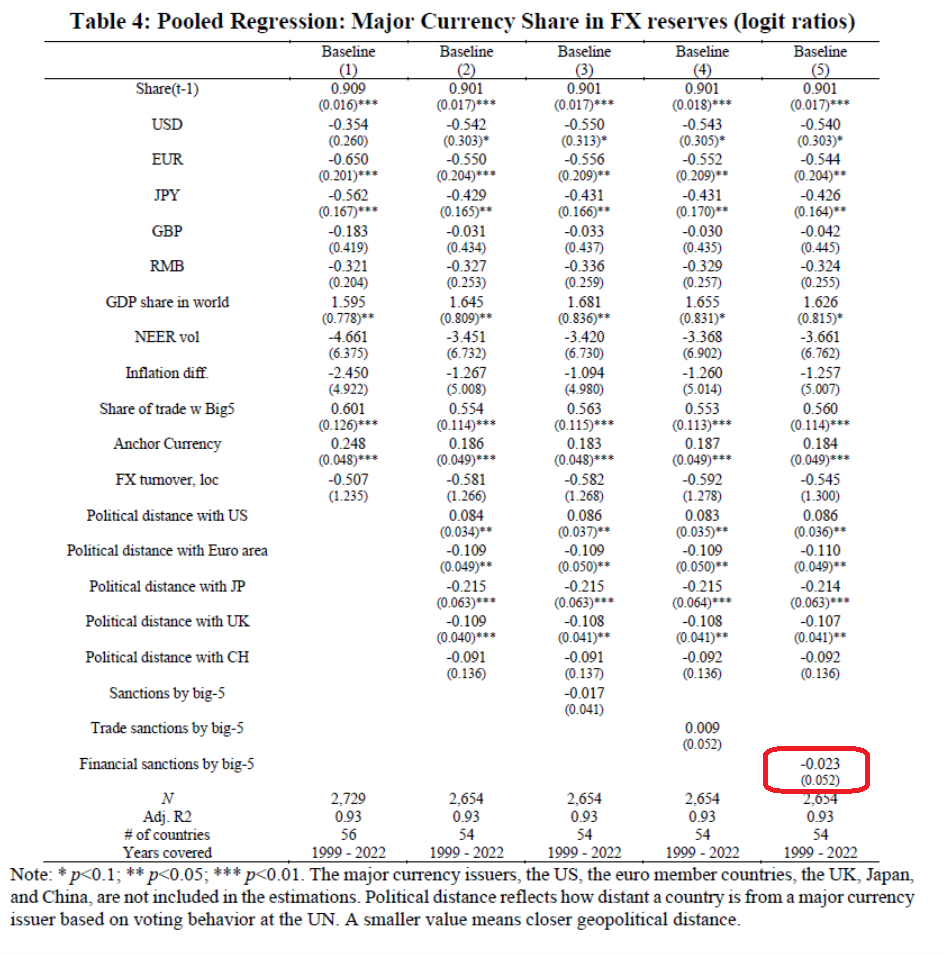

Will sanctions reduce dollar holdings? Unfortunately, there is no data for the period following the escalation of the invasion of Ukraine, but there are estimates for 2021.

source: Chin, Frankl, Ito(GMF2024).

The estimated coefficients are not statistically significant. They are also nonlinear and therefore somewhat difficult to interpret. Table A1.1 in the paper presents estimates from a linear stock regression on USD holdings, which makes the coefficient estimates easier to interpret.

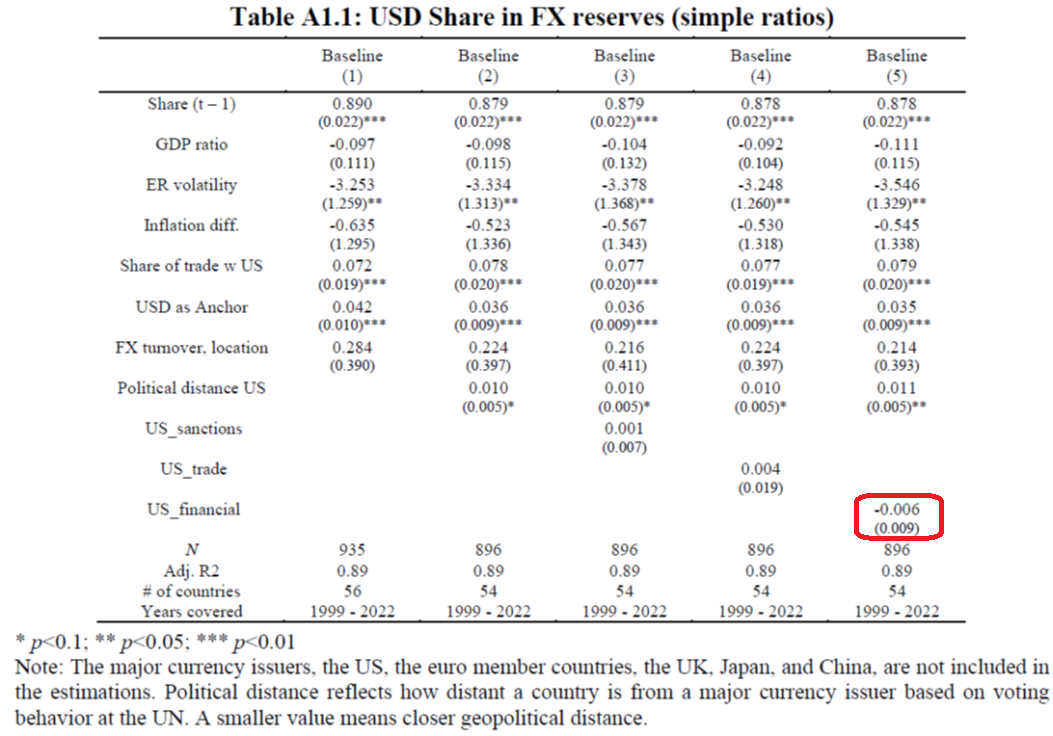

source: Chin, Frankl, Ito(GMF2024).

The point estimate is very small. ~ No (Statistically significant). If taken literally, the autoregressive coefficient is 0.88. In the long run The effect is 0.05, so when the US imposes financial sanctions on a country, on average, that country’s central bank holds 5 percentage points fewer US dollars. However, the 95% confidence interval includes 6 percentage points. Increase In dollar stocks.

Thus, the claim that financial sanctions would erode dollar dominance has not been empirically tested so far (perhaps data going back to 2023 would have yielded different results).