I am worried about the tariff policy that affects the economy. In general, accounting, administrative and trade policy decisions do not lead to immediate economic downturn, but these tariffs are a big mistake. There were other forced errors, such as reducing basic research spending, but this is a long -term problem.

Side: Imagine that a technology company has announced that it will reduce spending by removing R & D. Their shares will plunge. That’s what the United States did as some Doge cuts.

Summary, NOWCAST and tracking forecasts are reduced to Q1.

Figure 1: Figure 1. GDP (black), 4/1 (red triangle) of GDPNOW, and GDPNOW are gold imports (pink square), NY Fed (Blue Square), Goldman Sachs (inverted green triangle), SPGMI (orange inverted triangle) Investigation, billions of CH.2017 $ Saar. Source: BEA, Atlanta supplyPhiladelphia Fed, NY Fed, Goldman Sachs and Author Calculation.

NBER BCDC indicators and SPGMI’s monthly GDP (Monthly GDP):

Figure 2: Figure 2. Bold Blue’s benchmark revision employment, in December, apocalyptic NFP, December (thin blue), reported private employment (orange), industrial production (Red), CH.2017 $ (black) CH.2017 $ (black), (black) and Monther in CONDER in CH.2017 $ (BLACK) and Monther in CH.2017 $ (BLACK) Hiring NFP benchmark amendments, including personal income except personal income except for the current transmission and trading sales. CH.2017 $ (Pink), GDP (Blue Bars), all logs are normalized at 2021m11 = 0. Source: BLS Fred, Federal Reserve, BEA 2024Q4 3rd Release, S & P Global Market Insight (Nee macro economic advisor, IHS Markit) (4/1/2025 release) and the calculation of the author.

Monthly GDP and civilian employment (high volatility) are essentially flat, but consumption decreases compared to the highest level.

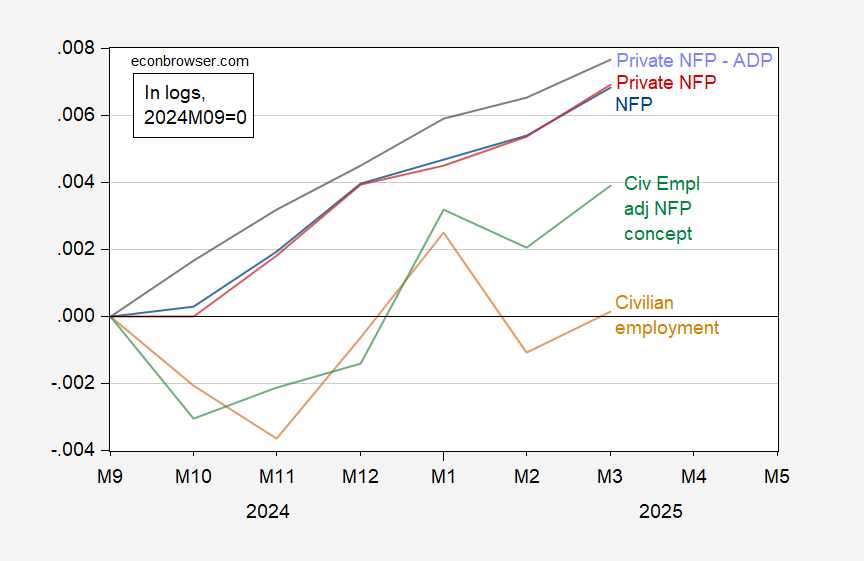

How is employment? It is still strongly growing by most accounts.

Figure 3: BLS (blue), personal NFP of BLS (Red), personal NFP, ADP (LILAC) personal NFP, NFP concepts adjusted with civilian employment, formula (green), formula (TAN), SA, SA, SA, Logs = 2024m09 = 0 Employment of non -abandoned benefits from the series. Source: Calculation of BLS, BLS and ADP and author through Fred.

In addition to civilian employment (high volatility), employment is still slower, but it is still increasing.

Therefore, anxiety is mainly based on “soft data”, and many of them look very soft.