Locking up Russia’s butter (CNN). Official inflation in October was 0.8% per month (annualized is about 10%. This is the official inflation rate. The ex post rate is about 11%.

Assuming the CBR’s expected inflation rate is 13.4% at par, this implies an ex-ante real interest rate of 7.6%. With the policy rate expected to rise to 23% at the December meeting, this means the ex-ante real interest rate is 9.6%, assuming inflation expectations remain constant.

There is an interesting question about whether the CPI figures coming from Rosstat can be taken at face value. recent Stockholm Transition Economy Research Institute report Observe:

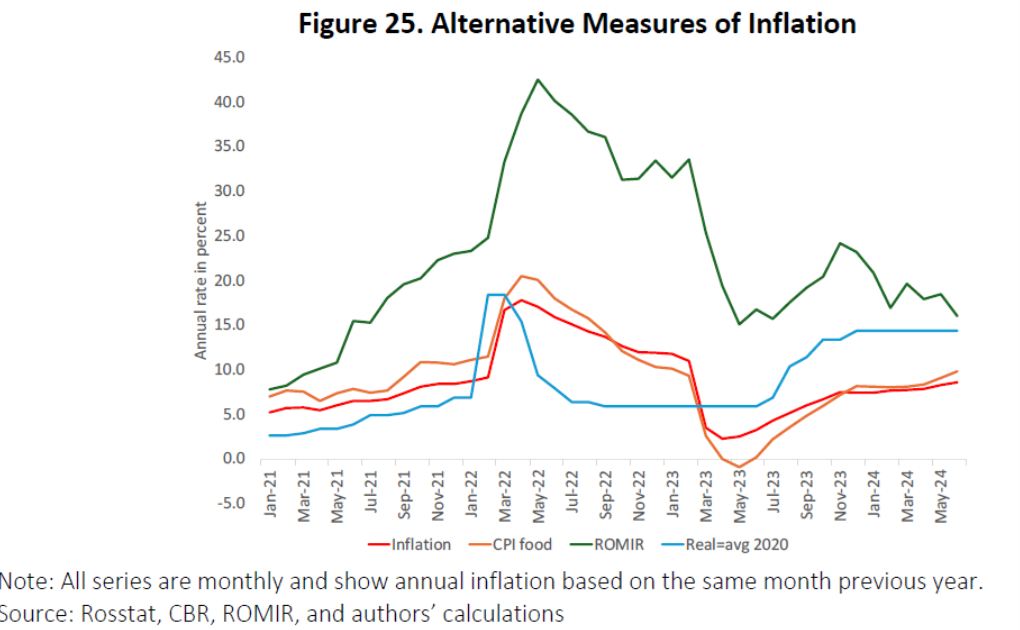

… Reliability of official inflation figures published by Rosstat. Figure 25 shows some alternative measures of inflation, suggesting that official figures may seriously underestimate the inflation faced by households. The first alternative measure is the Fastmoving Consumer Goods (FMCG) index produced by ROMIR, an independent Russian public opinion monitoring service.25 FMCG mostly includes food and cosmetics, and ROMIR estimates that FMCG accounts for about 50% of total household expenditure. I assume it is. Their index produces consistently higher inflation rates than the aggregate CPI and the food CPI index produced by Rosstat. In May 2022, their measure of inflation peaked at an annualized rate of more than 40%. It has declined significantly since then, but remains at about twice the rate published by Rosstat. The ROMIR inflation rate for June 2024, the most recent month currently available, is 16%, compared to Rosstat’s CPI and Food CPI inflation rates of 8-10%. Unlike ROMIR, Rosstat traditionally considers the share of food in Russia’s CPI basket to be 38%, which Milov (2022) argues is too low and leads to underestimation of inflation. Second, Rosstat observes the prices of goods that consumers actually buy. Sanctions and budget constraints have led many Russian households to start purchasing cheaper substitutes, and this substitution effect is unlikely to be reflected in the CPI.

Below is Figure 25 from that study.

source: Stockholm Transition Economy Institute.

Figure 25 also provides the implied inflation rate if the CBR were to keep the real policy interest rate at its 2020 level. If the natural rate (r*) is unchanged, it makes sense to use that logic to construct an alternative expected inflation series. However, I think the blue line is particularly questionable since r* has probably changed given the massive fiscal stimulus and labor stock losses.

In any case, if you combine the policy rate of 21% with 13.4% or 16% (10% official CPI + 6 percentage points of measurement error), the real interest rate is still quite high, at 5-7.6%.