I am quoting WSJ in the article. “Russia’s war economy is showing new cracks after the ruble plunge.”.

The Russian economy, which had been surprisingly resilient through more than two years of war and sanctions, suddenly began to show serious strain.

The ruble is plummeting. inflation It’s soaringand president Vladimir Putin This week he told the Russian people there was no reason to panic.

The catalyst for the change in economic fortunes was the decision of the Biden administration. to strengthen sanctions It’s in Russia’s Gazprombank, the last major unauthorized bank that Moscow uses to pay soldiers and handle trade transactions, and more than 50 other financial institutions.

While official statistics certainly depict a remarkably resilient Russian economy, there are certainly questions about its true strength (remember, “Potemkin village” is a term that originated in that country). First, the ruble’s sharp decline reflects the trade-offs being made between defending the currency, curbing inflation and maintaining economic growth.

Boffit, a week agoIt highlighted the deceleration in y/y growth.

Russian GDP growth slowed significantly in the third quarter.

According to Rosstat’s preliminary estimates, Russia’s GDP growth in July-September was 3.1% compared to the same period last year. GDP growth slowed significantly this fall. All key sectors have seen slower growth in recent months compared to the first half of the year.

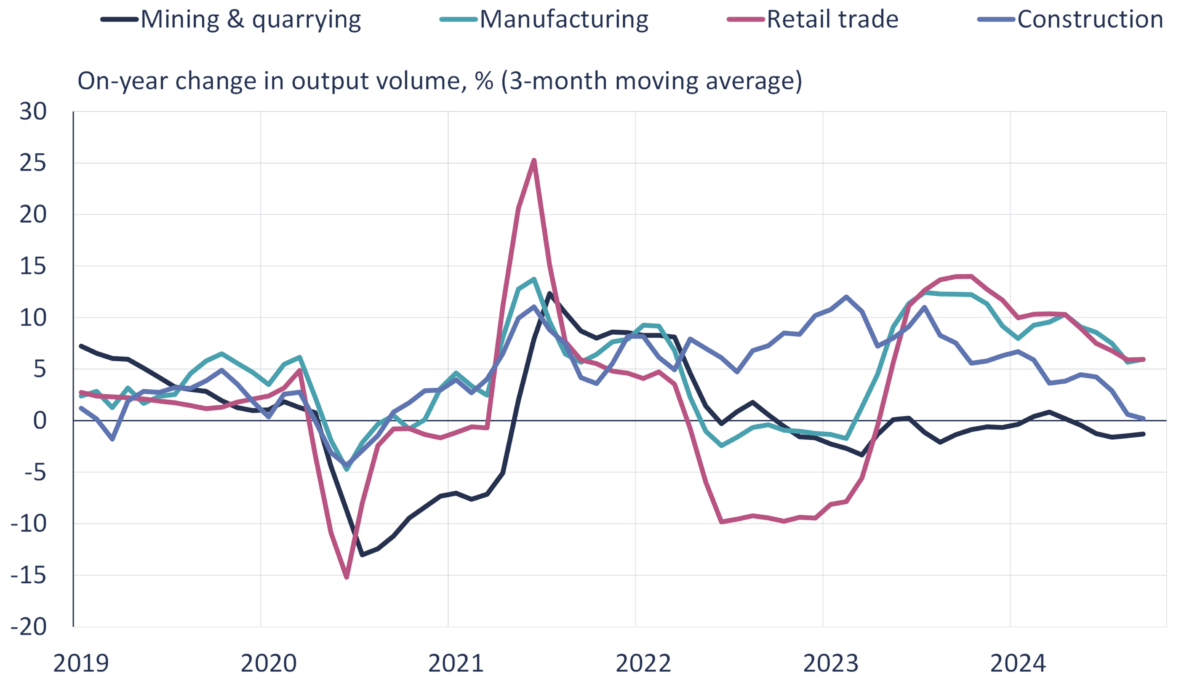

The slowdown in GDP growth was mainly driven by pressure from the mining, quarrying and construction sectors. Year-on-year production in mineral extraction industries (including oil and gas) has declined in recent months, while year-on-year growth in the construction sector is virtually zero. Agricultural production also decreased in the third quarter. GDP growth was still supported by manufacturing and retail, but growth also slowed in these sectors. Manufacturing growth was primarily driven by war-related industries.

Here’s a graph using official statistics:

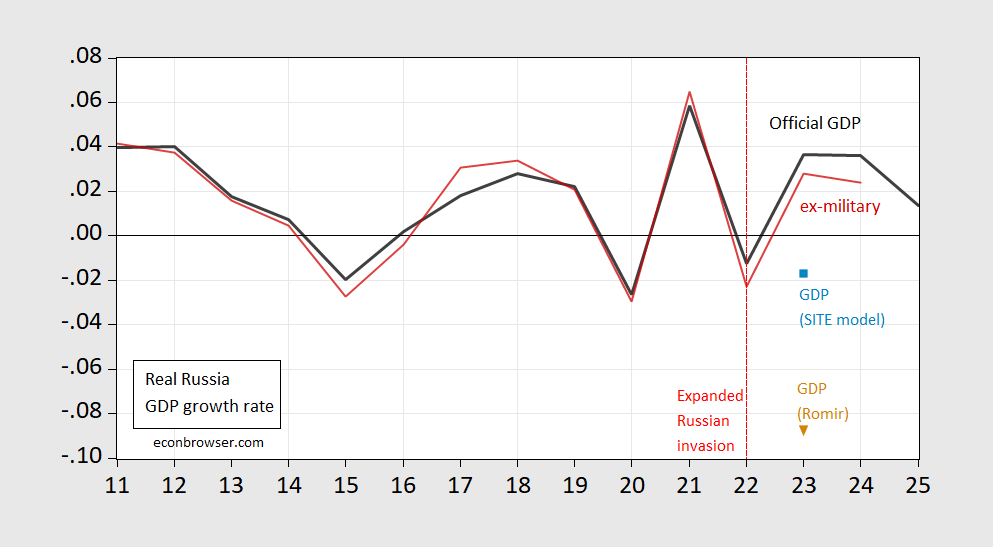

Finally, let’s consider the validity of Russian statistics and what GDP measures. First, we compare official GDP with official GDP before military spending. Sipri):

Figure 1: Official Russian GDP growth (black), growth in military spending before official GDP (red), Russian GDP using the SITE oil-based model (light blue square), official GDP using the Romir price index as a deflator (tan inverted triangle). GDP defense spending is calculated using nominal values and scaled by the overall GDP deflator. Source: IMF October 2024 WEO; SIPRI database, Sipri, earth (Figure 26) and author’s calculations.

The robust growth appears less robust when explicit military spending is deducted (capital costs associated with defense spending, along with other internal security operations, are not included in SIPRI’s military spending estimates).

Additionally, the Stockholm Institute of Transition Economy Latest Russian economic reportsThe y provide several alternative estimates of Russian GDP growth. I show two estimates. (i) based on a simple econometric model linking oil prices to Russian GDP, and (ii) nominal GDP deflated by the Romir price index (see this post).

/cdn.vox-cdn.com/uploads/chorus_asset/file/25762139/STKS488_TARIFFS_CVirginia_D.jpg?w=150&resize=150,150&ssl=1)