It is a fun question to ask that the Russian government debt for GDP is not so great. Craig Kennedy Considering the compulsory bank loans, it argues that (accidental) government debt means that it is much larger than the previously defined public debt. here). Summary:

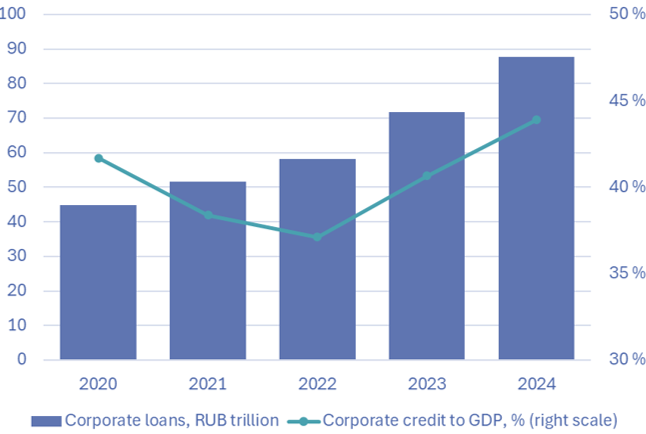

Moscow has secretly pursued a double track strategy to fund the cost of war. One track is composed of a highly close defense budget in Russia, and analysts were regarded as “surprisingly elastic.” The second track (the second track that is overlooked so far) is an enthusiastic issue in the financial system with a low budget that seems to occupy the main part of Russia’s overall war spending. According to the legislation enacted in February 2022, the state controlled war -related loans at major Russian banks. It is instructed to expand the priority loan to a wide range of businesses that provide goods and services to war in terms of terms set by the government. Since mid -2012, the war funding system has helped to lead a large part of Russian anomalous ₽36.6 TRN ($ 446 BLN).

At first, it was found to be favorable to Moscow by limiting budget spending on this budget by limiting the budget expenditure of this budget. The people who kept the budget concluded that Moscow is not faced with serious dangers in the ability to maintain funds for war with Ukraine. Recently, however, Moscow’s dependence on the national supervision of the national supervision began to seriously affect at home. It became the main driving force of Russia’s 10% inflation and sent a central bank’s main rates to 21%.

More extensively, war debt other than Russia’s budget is significantly increasing the systematic risk of near -range and mid -term. High interest rates increase the level of suffering in the “real” economy and fear of extensive bankruptcy. The central bank expressed concern about “aggressive” loans and inappropriate capital buffers in the banking industry. In addition, the state has now buried banks with a lot of problems. If the shooting is stopped and the defense contract is canceled, many people can turn toxicity. More bad means that this problem may not occur until the bank regulatory agency is too late.

In late 2024, Kremlin was briefed on the risk of increasing risks and warned that changes were needed. This causes dilemma to Putin: It continues to rely on debt other than budgets, increases the risk of a terraced credit event that undermines Russia’s image of Russia’s “amazing elasticity” and weakens negotiation leverage. Alternative: The major increase in budget deficit (bad optics with bad optics) or rapid reduction in war spending. This can be explained to President Putin’s recent generals, “I can’t pump my spending on infinity.”

These new developments can affect Moscow’s war aesthetics in two ways.

- Moscow tends to believe that time is on the side. The higher the cost of war, the higher the risk of increasing credit events.

- Moscow will prioritize sanctions with the goal of increasing cash flows to help restructuring and reviews in the politically dangerous postponement. The concessions that provide the largest cash flow slogan include (i) easing oil sanctions, resuming pipeline gas delivery to Europe (II) and constantly (III) Russian asset funds.

Considering the financial problems of Russia, this constraint on Russia’s cash flows allows Ukraine and allies to maintain significant leverage. If you stay in place after the ceasefire, they can play an important role in securing final comprehensive peace settlement, including compensation.

Kennedy presents this picture of a company borrowing to abandon his claim. See the whole Report here.

source: Kennedy (2025).

Contrast view, see Kollyandr and Prokopenko (2025) (Carnegie Endowment).

Bofit This corporate loan graph is provided (GDP?