EJ Anthony/Heritage presents photos that will amaze us.

source: EJ Anthony/X.

I can imagine Secretary Yellen “coercing” Russians who are trying to evade sanctions. I can imagine Secretary Yellen “coercing” tax evaders. I have to confess that I can’t imagine Yellen “coercing” Jerome Powell. I would like to know where Dr. Antoni got his information on this.

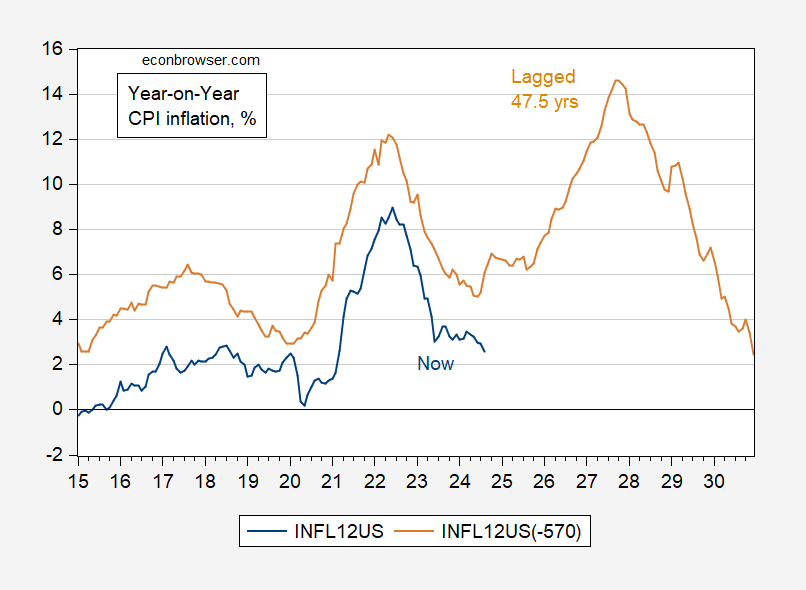

Anyway, I thought the picture was a little off, so I maximized the correlation to reproduce the peak and trough of inflation. The magic number was 47.5 years.

Figure 1: Annual CPI inflation (blue) and 47.5-year lagged (brown) both in %. Source: BLS via FRED, author calculations.

This seems to suggest that inflation reared its ugly head again in 1979, due to the early easing of monetary policy. While this may have contributed to the acceleration of inflation in 1979, it seems necessary to take into account the commodity price shocks that occurred in 1978 and 1979, the biggest of which was oil…

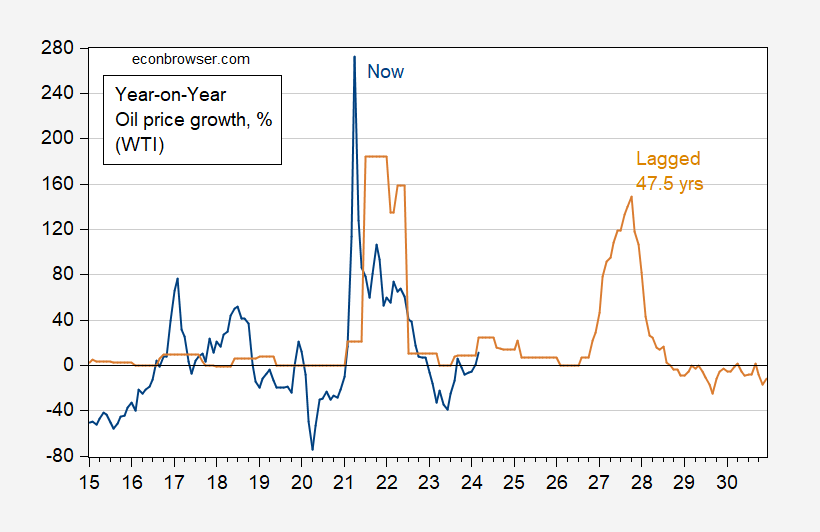

Figure 1: Annual growth rate (blue) and 47.5-year lag (brown) of the price of oil (WTI) are both %. Source: EIA via FRED, author calculations.

So, with oil prices expected to surge by around 160% in 2027, CPI inflation is also expected to surge again. Blanchard and Galli (2009) As noted earlier, output and inflation are less sensitive to oil shocks than they were in the 1970s and 1980s.