EJ Antoni (Heritage) is skeptical of GDPNow (and other nowcasts) regarding Q3 growth. X aka Twitter today:

Latest Q3 Nowcasts: ATL 2.5% (previously 2.0%) NY 2.49% (previously 1.94%) STL 2.05% (previously 1.65%) It will take strong consumer spending numbers in August and September to make this a reality.

I wonder about this given the measured acceleration in real consumption growth (AR 4.6% m/m in July). GDPNow Report We can check the current forecasts, as we have current forecast growth for components like consumption. GDPNow on August 30th penciled in 3.8% q/q AR growth. How does the picture look?

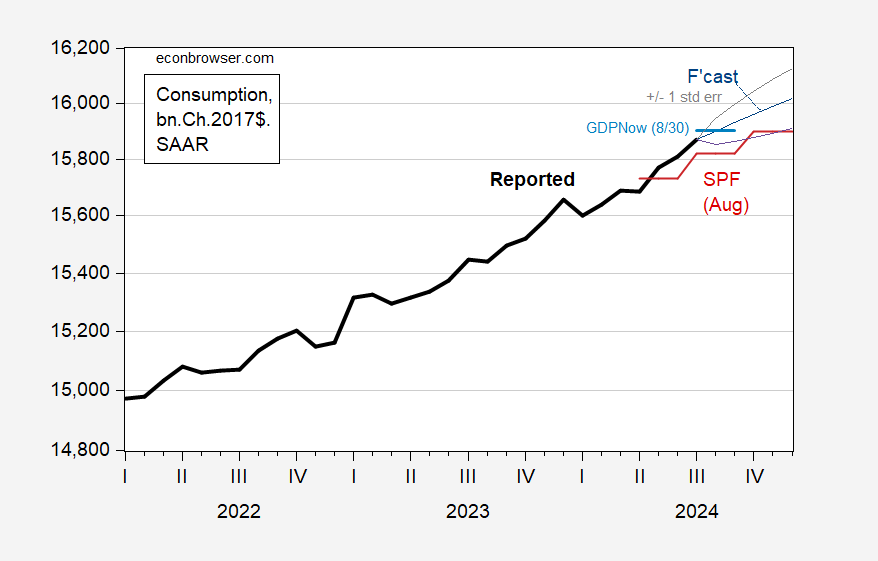

Figure 1: Consumption (bold black), GDPNow as of Aug 30 (blue line), August SPF median (red line), ARIMA(0,1,0) forecast (blue line), +/- 1 standard error band (gray line), all in bn.Ch.2017$, SAAR, log scale. Forecasts are log-first differencing estimates, 2021M07-2024M07. Source: BEA, Philadelphia Fed, Atlanta Fed, author calculations.

Granted, GDPNow’s current forecast for consumption is higher than the August SPF median (even though this forecast was generated in early August). However, based on a simple autoregressive model, a 3.8% q/q AR consumption increase is not statistically surprising at all.