-

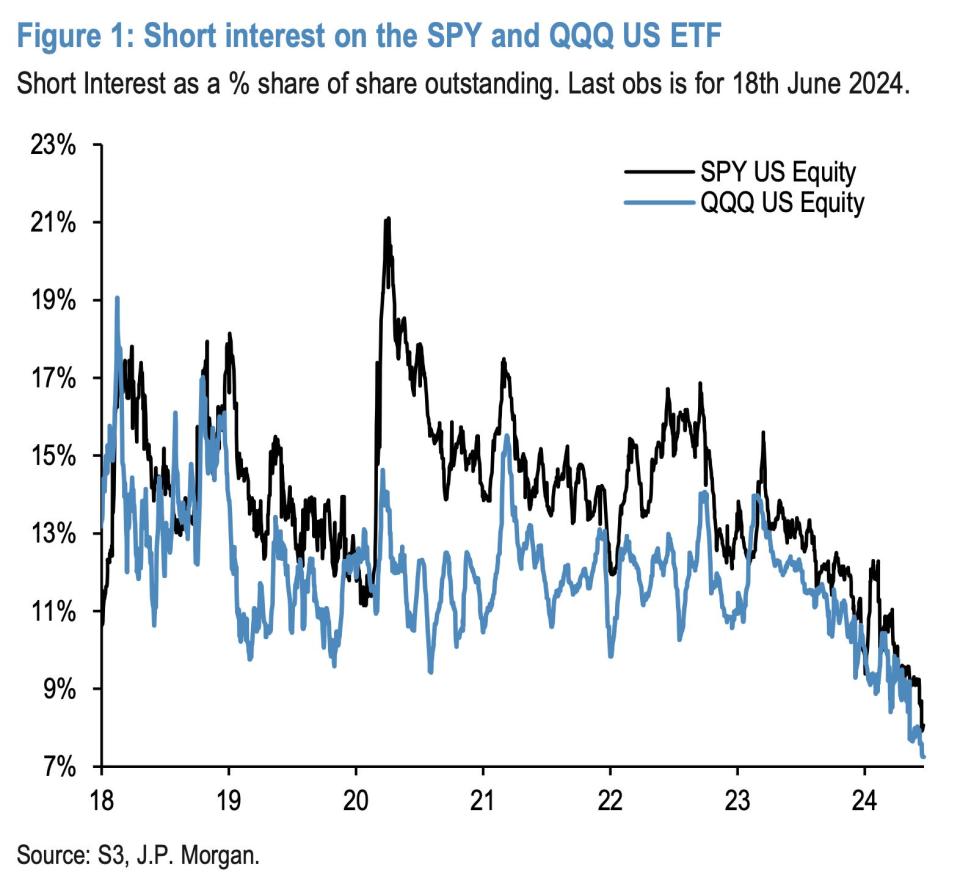

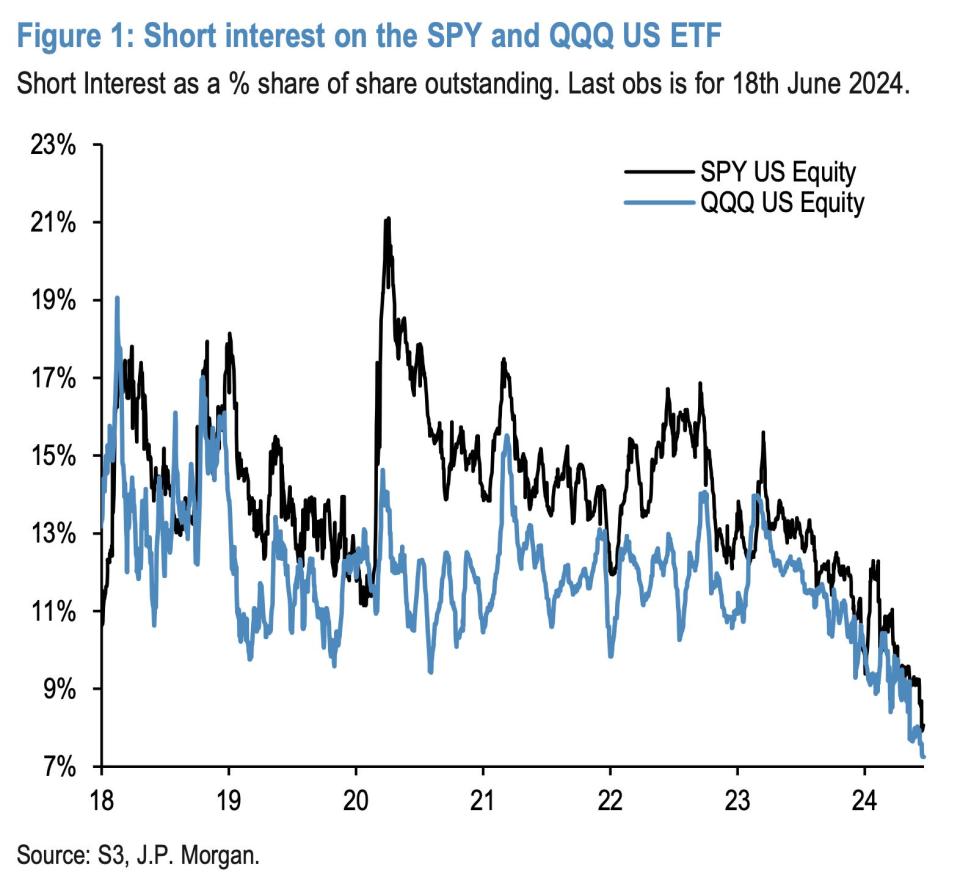

JPMorgan said short-term bets on funds tracking major U.S. indices fell to record lows.

-

There are three main reasons why short sellers withdraw from the market.

-

Low levels of short selling can trigger volatility in the market when negative news comes out.

JPMorgan said on Thursday that non-stop highs in U.S. stock markets have turned short selling into tough trading and sent investments in U.S. indexes tumbling.

As follows S&P 500 and Nasdaq Short-term interest in funds that track the index has declined following consecutive record highs this year, the bank said.

“The decline in short interest for the SPY and QQQ ETFs to consecutive lows has provided steady-flow support for U.S. stocks over the past year, helping to curb volatility and acting as an implicit short-term trade,” analysts led by Nikolaos Panigirtzoglou wrote. He said.

According to them, three main factors make this a particularly difficult market to trade.

First, it is expensive to hold short-term bets when a stock or fund is rising, a risk especially relevant in today’s bull market. The excitement of artificial intelligence, the possibility of interest rate cuts, and a resilient economy have all contributed to the trading frenzy.

As a result, the S&P is up nearly 15% year-to-date and the Nasdaq is up 32.3%.

Second, regulators have added restrictions on short selling by requiring transparency and adding costs to short selling of stocks, JPMorgan said.

Finally, industry players are increasingly pulling back as the wall for retail investors to participate increases, with Gamestop’s famous meme rally of 2021 being the best example.

“It’s no secret that the long/short equity business model is under pressure and interest in fundamental stock pickers has waned,” prominent short-seller Jim Chanos wrote in November. A letter explaining why he left the job.

According to JPMorgan, short positions are disappearing from individual stocks as well, with the top seven major stocks clearly falling.

The withdrawal supported a surge in the stock market, but could cause problems in the future, the bank added.

“Given how low their short-term interest rates are currently, these implicit short-term trading transactions appear to be rather extended by historical standards, raising vulnerabilities for U.S. stocks in a scenario where negative news begins to reverse last year’s decline in short-term interest rates,” the analysts said. “I do,” he wrote.

JPMorgan didn’t name names, but analysts have long warned of a number of news stories threatening the market. These include the prospect of rising long-term interest rates, a resurgence in inflation, falling earnings or a geopolitical rupture.

Read the original article business insider