The Trump tariff announced on April 2 is so stupid that I can barely stand to discuss them. But I can’t do it because their influence will vary so far.

Interestingly, Russia, which is already superior, is already a great relative winner by fiscaling the southern part of the world and becoming more atarky. But as a trade partner begins to limit, you will still experience used results.

But it was expected that the United States was expected to harvest Trump, but the United States is probably not a big victim in the early days. The odds prefer the emerging economic crisis first. JOMO has been warned in developing countries for at least a year and a half of financial catastrophe, and has been warned by high dollars and slow growth worldwide. Although the project has pointed out the dollar that falls into a global currency index, this weights on the big economy. As we discussed more, Southeast Asian currencies decreased for green bags. Some countries in the area are not already due to foreign debt exposure, but have been at risk of crisis due to excessive domestic debt. Trump’s head kicked his head to push them into a dangerous zone.

Another area I am not used to is Central America. Their economy relies heavily on the remittance of the United States, and Trump is working very hard to decrease. The United States runs trade surplus with Central America. but Member states will still face 10%”basic tariffs.”. Trump is not interested in the wonderful things like the treaty (e.g. JCPOA), but according to the Reuters, Guatemala has already complained. The new tariffs violate the DR-CAFTA Trade Agreement.. Mexico, which operates a large surplus with the United States, is somewhat financial crisis, unlike the ordinary super bad economic downturn that is protected thanks to its large FX reserves.

The point for emerging markets is contagious. Investors operate reflexively when the emerging economy collapses, not Tree One. A country with a seizure and a similar color will be avoided. It means above all, the value of the currency will fall.

We have a real number, so we can expect some stabs in the analysis for the next few weeks. Some experts argued that China will not be significantly affected because exports to the United States are only 3%of GDP. First, it is not a minimum number. Second, due to the reduction in cost and/or debate, China has moved some production to Southeast Asia, especially Vietnam and Mexico. Third, Trump also aimed at all countries except Russia and North Korea. At least, they will reduce economic activities and return to trade with China.

If the reader has the initial witness of a manufacturer, exporter or broker, go up to the pipe.

Some outline. The White House Fact Sheet is as follows. Note Trump consciously arouses the national emergency when he is the cause. In a separate fact sheetHe has removed the exemption of De Minimus from May 5th. Although the system is not well written, it seems to include only products in China and Hong Kong.

US stock market It was ready It opens rapidly. The US dollar sank more than 2% of Euro, Japan and Swiss Francs. Both oil and gold fell, and investors rushed for the safety of treasures.

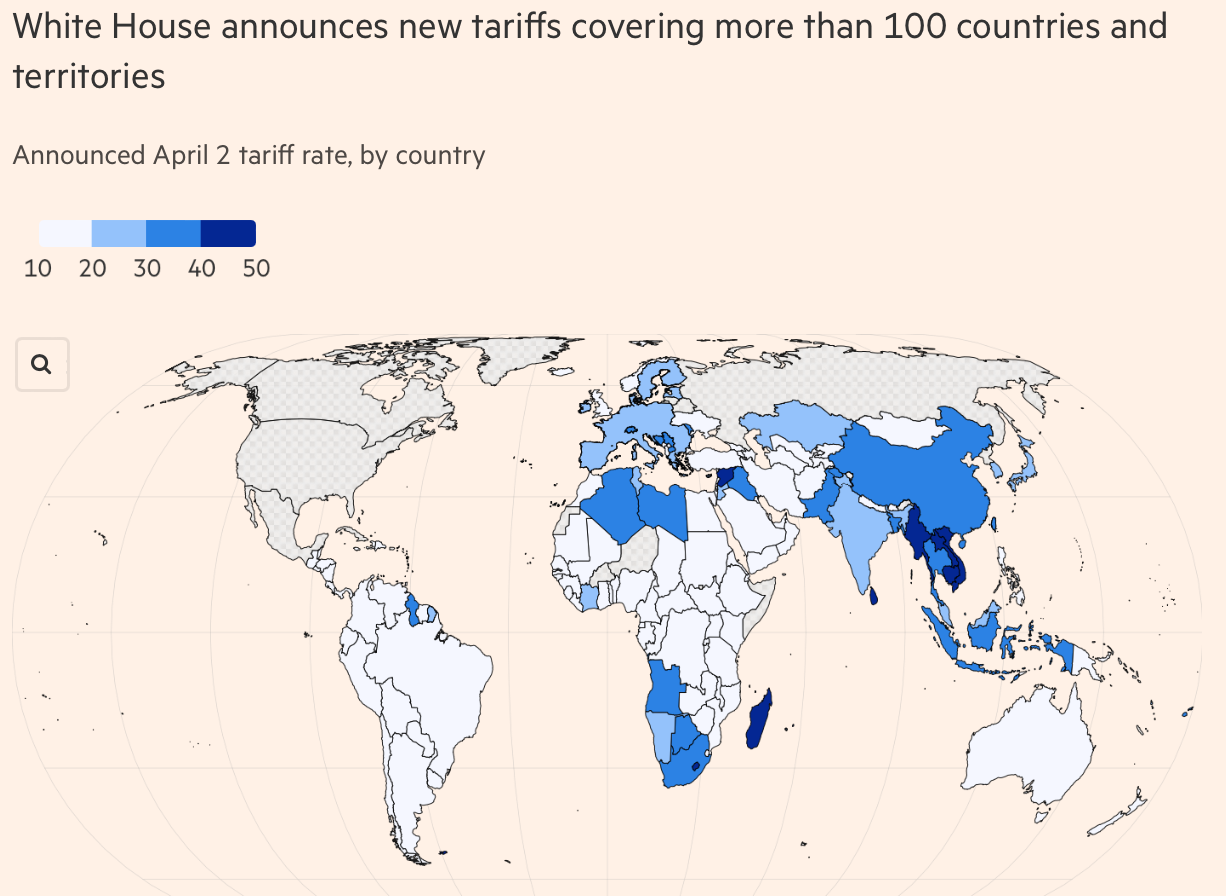

All US imports are A 10% tariffFrom April 5th.

Trump will impose a much higher rate In some countries where the White House considers bad actors in trade. For example, Japan faces 24% obligations, and the European Union has a 20% imposition from April 9.

China will be right New 34% tariffAdded to previous missions, such as 20% tariff Trump imposed on Pentanil. This means that the basic tariff rate of China’s income will be 54%before adding an existing imposition.

Target is fixed Trump says that another country is imposed on the United States. Here is mathematics Behind Levi.

Some global leaders I vow to retaliateOthers still hope to have time to deal with the United States.

Canada and Mexico Excluded In the mutual tariff system.They still plan to impose a 25%tariff on most imports to the United States, but the administration has provided exemptions for automobiles and other products. Here is a list Products and countries are exempted In tariffs.

Trump 25% tariff It was fermented in automobiles and parts made in foreign countries. 12:01 AM ET.

Customized tariff on the ‘worst criminal’

White House officials also said they would impose a description of a specific customs tariff for about 60 of the “worst criminals.”

These are effective on April 9th.

Trump officials say that these countries acted as a way of claiming high tariffs on US products, imposing a “pessimism” barrier to US trade, or weakening the US’s economic goals.

The main trading partners according to these custom tariffs are as follows.

- European Union: 20%

- China: 54% (including initial tariffs)

- Vietnam: 46%

- Thailand: 36%

- Japan: 24%

- Cambodia: 49%

- South Africa: 30%

- Taiwan: 32%

The Financial Times was weighted Donald Trump crying for economists with tariff formulas.:

The formula used to calculate the tariffs announced by the US trade representative was a representative of unfair practices, taking the US trade deficit for products with each country, and then divided into the amount of goods imported from the country to the United States.

As a result, tariffs are half of the proportions between the two, with countries such as Vietnam and Cambodia (a large amount of manufacturing products to the United States, but only a small amount from the United States is imported, attracting 46 %and 49 %of punishment tariffs, respectively.

In contrast, the United Kingdom, which received annual product transaction surplus last year, will only be hit by a 10 % tariff applied to all countries that prohibit Canada and Mexico.

Economists argued that the USSTR methodology was an economically deep defect and would not succeed in the stated goal of “leading quantum trade defects to zero.” Despite the claim that the White House’s “tariff works,” they added that trade balance is led by many economic factors, not just tariffs.

Economists also attacked Trump’s obsession with reducing quantum trade deficiency to zero, always economically unlawful, because the state grows or economically impossible.

Some people hope that this is just a Trump opening bidding and can be saved. But the administration is making confused noise. In NBC:

In the early days of Trump, I was sending a mixed message yesterday by the shock tariff presentation.

In X, Eric Trump, the second oldest son of the president and the principal of Trump’s organization, predicted that the talks would begin.

“I don’t want to be the last country to negotiate trade transactions with @realdonaldtrump,” he wrote. “The first negotiations will win -the last will be absolutely lost. I watched this movie for the rest of my life.”

But CNN, a White House reporter, Karoline Leavitt, said there would be no negotiations. She urged Wall Street to call for “trust in President Trump,” and rejected the idea that he would withdraw his tariffs before Trump came into force.

After US President Donald Trump said there would be no mutual tariffs, the pharmaceutical company sighed on Wednesday. However, it can be proved that the White House can move forward in making this sector plan.

The Trump administration is considering about 232 so -called 232 investigations among other industries, which can lead to import tariffs under the Trade Expansion Act, Bloomberg cited high -level administrative management on Wednesday.

However, CNBC, an association of Annie Lennox, also said, “Some of them want abuse”:

According to preliminary estimates shared by Prime Minister Donald Tusk, the US tariffs can pay 0.4% or about 10 billion zlotys ($ 2.66 billion) of gross domestic product.

“Because it comes from the nearest allies, serious and unpleasant hits will survive. Our friendship must be able to survive this test.”

Bloomberg cleans the neck and so far US investors are the biggest losers (This is big and it’s not clear outside the advanced economy, and Southeast Asian currencies fall compared to the dollar):

The shaking of Donald Trump’s global trading system harms US assets more than many of the large economy assets he just hit with additional tariffs.

After the US President closed the market on Wednesday, the US stock index futures fell by more than 4% and the dollar gauge surged. But the other influence was less extreme. The STOXX EUROPE 600 fell 1.3% in the morning trading, while the Euro rose 1.3% from the dollar, the highest level since October. Asian stocks have fallen to 1.7%.

To make it look like a parish In Bangkok Post:

The US President Donald Trump’s largest tariffs in Asia’s emerging countries have fallen and calls with Southeast Asian stocks. Vietnamese stocks fell.

Vietnam’s major stock indexes slipped to 6.2%, down up to 1 day for more than four years, while stocks in Thailand, the Philippines, Malaysia and Singapore also decreased. Thailand Baht has weakened about 0.8% of the dollar, and Vietnamese and Malaysian ringgits have fallen.

On Wednesday, Trump’s mutual tariffs were subject to Southeast Asian assets, especially after the area was hit. He said the United States would account for 46 percent of Vietnam’s exports, 36 percent in Thailand and 32 percent in Indonesia. China, the largest trade partner in the region, faces 54% of the cumulative tariffs.

Nguyen ANH DUC, head of the institutional brokerage and investment advisory at SBB Securities CORP, said, “It is not surprising to see panic sales as local investors expect 10%to 15%tariffs.

The cost of guaranteeing sovereignty debt in Southeast Asian countries has also increased. According to merchants, credit-national swaps that track emerging Asian bonds have expanded the most in 19 months.

If trade tensions rise further, additional pressure on Asian currencies can increase. Indonesia rupiah dropped 2.8%this year and fell to the weakest level last month since the 1998 Asian financial crisis.

We must wait until other shoes, especially mutual tariffs. But it is difficult to appropriately express how this is ignorant and brutal destruction.