at “Recession blonde: How economic uncertainty promotes the latest hair color trend”March 17:

What is “recession blonde”?

The recession blonde (or recession brown hair) is a darker, brown shades that many people generally grow with bright and golden strands. Tiktok users may look like “old money blonde” Their natural roots grow In fact, it refers to the economy of the economy It affects spending habits; Many people are refusing to make a touch -up promise to save money.

The cost still depends on the color of the color, but maintaining the blonde hair can be quite investment and often more expensive. “There are too many complexity for blonde and there are various ways to achieve the final goal.” Zena Ferry Say popularity. “The double process, Hyper Blonde, is one of the most labor intensive things to provide the biggest blonde shock to the colorist. The highlights are generally more natural, but it may be easy to see, but the skilled application is similar to the training of a trained painter and painter. [cost] Scope according to color list. ”

…

I personally didn’t notice this trend, but it doesn’t mean much. I tried to find data on hair salon spending, but it is BEA’s “Personal Nursing and Clothing Service” category that can be obtained at the closest frequency. I plot the log ratio of the actual measurement of personal medical services as a total consumption (keep it in mind).

Figure 1: Figure 1. Log ratio of individual nursing and clothing services of $ (blue) in 2017. The NBER has a grade gray shaded date with the defined peak-troph. Source: BEA and the author’s calculation.

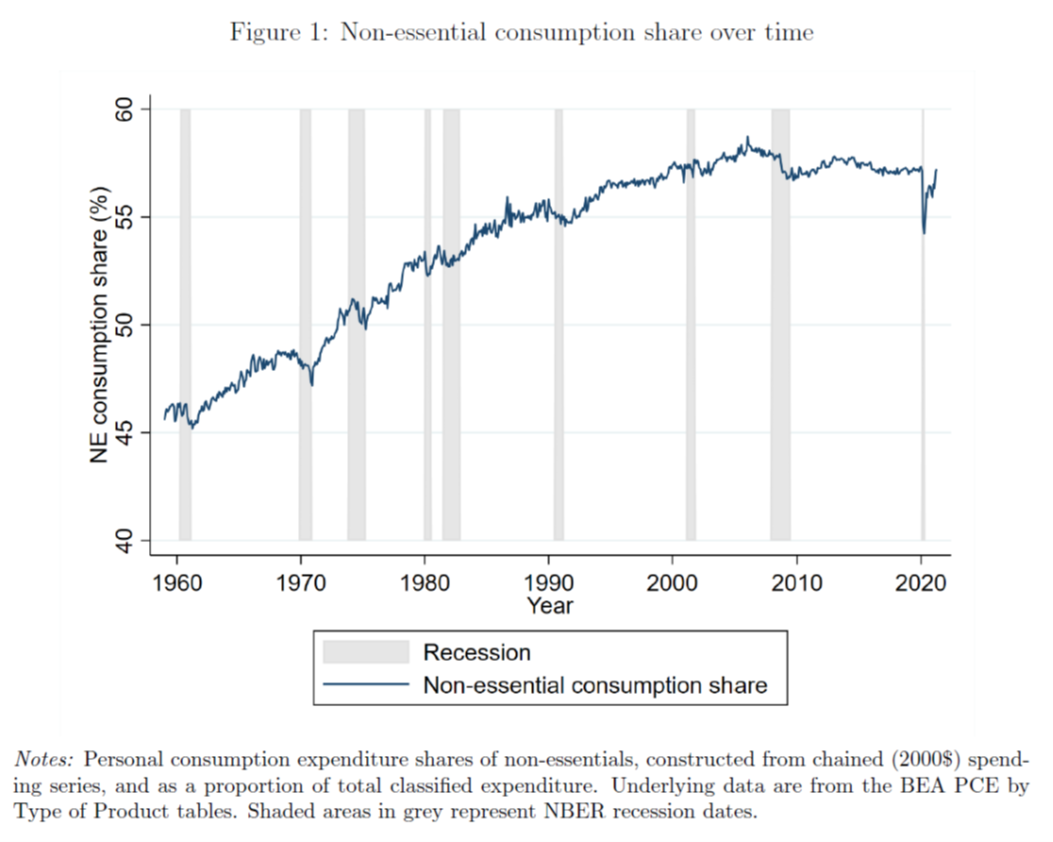

The recent peak is 2024Q1 and has been decreasing since 2024Q4. How reliable is such an indicator? This real series returns to 2007Q1 at the quarterly frequency. But as discussed in this post, Michele Andreolli, Natalie S. Rickard and Paolo Surico performed more official analysis. “Non -essential business cycle”

In green:

By using newly built time series consumption, price and income in the required and non -essential sectors, we record three major empirical rules for World War II data. (i) Essential costs are more sensitive to business cycles than required spending. (ii) Imports from non -essential sectors are more periodic than essential sectors. (III) The chief diseases are more likely to work in the non -essential industry. We develop and estimate structural models that have two spending products that match these discoveries, non -military preferences compared to consumers and heterogeneity. We use the model to visit the transmission of monetary policy again and discover that the interaction of periodic product demand and periodic labor requirements greatly amplify the business cycle fluctuations.

Here is an important picture.

source: Andreolli et al (2024).

See Orchard (2024).

Therefore, one thing to see is Q1 consumption and level. Continued downward exercises of “personal nursing and clothing services” can signal an imminent stagnation.