by calculated risk November 30, 2024 08:11:00 AM

The main report this week is the November employment report released on Friday.

Other key indicators include October trade deficit, November ISM manufacturing index and November vehicle sales.

—– Monday, December 2nd —–

10 AM: ISM Manufacturing Index For November. The consensus increased from 46.5% to 47.5%.

10 AM: construction cost For October. It was agreed that spending would increase by 0.2%.

All day: light car sales For November.

The consensus was SAAR 16 million in November, unchanged from the BEA estimate of 16.04 million SAAR (seasonally adjusted annual rate) in October.

This graph shows light vehicle sales since BEA began keeping data in 1967.

—– Tuesday, December 3 —–

10 AM: Job postings and personnel turnover surveys BLS October.

10 AM: Job postings and personnel turnover surveys BLS October.

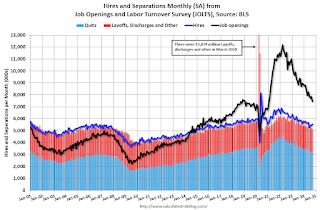

This graph shows JOLTS’ job openings (black line), hiring (purple), layoffs, layoffs and other (red column), and retirements (light blue column).

The number of jobs decreased from 7.86 million in August to 7.44 million in September.

The number of job openings (black) decreased by 20% compared to the previous year. The retirement rate decreased by 15% compared to the previous year.

—– Wednesday, December 4 —–

7 a.m. ET: The Mortgage Bankers Association (MBA) releases findings on: Mortgage Purchase Application Index.

8:15 AM: ADP Employment Report For November. This report applies to private payroll only (not government). The consensus was for 166,000 new jobs, down from 233,000 in October.

10 AM: ISM Service Index For November. Consensus fell to 55.5 from 56.0.

1:45 PM: Discussion, Federal Reserve Chairman Jerome PowellModerated Discussion, New York Times DealBook Summit, New York, NY.

2pm: Federal Reserve System Beige BookThe Federal Reserve’s informal review of current economic conditions in a region.

—– Thursday, December 5 —–

8:30 AM: First Weekly Unemployment Claim The report is made public. The number of initial claims settled was 220,000, up from 213,000 the previous week.

This graph shows the U.S. trade deficit with and without oil through the most recent report. The blue line is the total deficit, the black line is the oil deficit, and the red line is the trade deficit excluding oil products.

It was agreed that the trade deficit would reach $78.8 billion. The US trade deficit in September reached $84.4 billion.

—– Friday, December 6 —–

8:30 AM: employment report For November. 183,000 jobs are expected to be added and the unemployment rate is expected to remain unchanged at 4.1%.

8:30 AM: employment report For November. 183,000 jobs are expected to be added and the unemployment rate is expected to remain unchanged at 4.1%.

In October, 12,000 jobs were added and the unemployment rate was 4.1%.

This graph shows jobs added by month since January 2021.

10 AM: University of Michigan Consumer Sentiment Index (December reserve)