Like most investors, you like the long-term upside of the market. You just don’t want to suffer the occasional (and sometimes painful) setback. The problem? You never know when a crash will come. The best you can hope for is to minimize the pain after a crash. And the best way to do that is to take a good position before a big crash forms.

Against that backdrop, there’s one name I’d like to own right now in case a market crash comes. It’s this one. Analy Capital Management (NYSE: NLY).

Haven’t heard of it? Don’t worry, you’re not the only one. It’s not a household name and has a market cap of just $10 billion, so it doesn’t get much attention from the financial media.

But it works surprisingly well for investors.

What is Annaly Capital Management?

Annaly Capital Management is Real Estate Investment Trust (REIT). As the name suggests, REITs are real estate-focused organizations. REITs own a variety of properties, from hotels and office buildings to shopping malls and apartment buildings. But in all cases, the primary goal is the same: to generate reliable, recurring income for shareholders.

Annaly is unique even by REIT standards. Rather than owning rental or income-generating real estate, the company’s business combines servicing mortgage loans and buying and selling mortgage-backed securities issued by government agencies. Fanny Mae or Freddie MacAnd essentially, they are engaging in interest rate arbitrage between the cost of their own borrowings and the yield on the mortgage-backed securities they own.

It sounds crazy, but in some ways it is. The business model is 100% tied to the ebb and flow of the U.S. mortgage market, driven by constantly changing interest rates. Sometimes this business is predictable. Sometimes it is not. And just because it is predictable doesn’t necessarily mean that mortgage REITs have an easy way to protect themselves against the setbacks that come.

But in the end, Annaly Capital Management succeeds. Since its founding in 1996, the REIT’s total return has been SNP500Profits over the same period were large, and Annaly’s net income continued to be paid out largely in the form of large dividends, even when overall markets were struggling.

Favorable separation

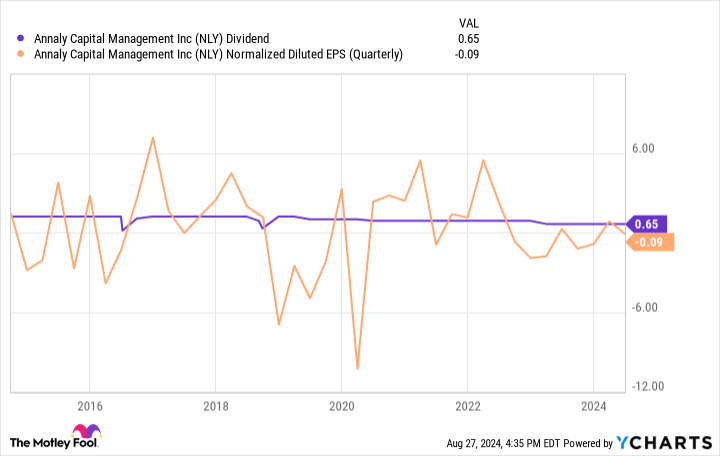

Don’t get the message wrong. For anyone who needs consistent and predictable investment returns, Annaly Capital Management can be a tough ticker to rely on. The payouts don’t necessarily increase with inflation. If It does not grow at all. Sometimes it shrinks, reflecting the ongoing changes in the underlying mortgage lending market in which this REIT operates solely. The price of this ticker is often lowered, so that the yield more accurately reflects the prevailing risk-adjusted yield at a given time.

A REIT’s underlying income (called distributable income) is also affected by changes in interest rates themselves, which may require the organization to adjust its dividend payments from time to time.

However, Annaly Capital Management is still a great defensive option during a market crash for a couple of related but different reasons: (1) This business does not necessarily rise and fall with the stock market; (2) Annaly’s current 13% yield backs up its dividend, which will be paid regardless of market performance for the foreseeable future.

However, this is better than the average annual return of the S&P 500.

To be clear, owning a stake in this REIT does not guarantee that you will be better off if the stock goes down significantly. After all, there are no guarantees in this business. In the end, anything can and will happen.

But that’s not the point. The best you can do is give yourself the best chance of defending yourself from all the blows of a massive selloff. Annaly at least gives you a reasonable chance of doing so. In the meantime, it’s distributing a significant amount of cash in the environment. Growth stocks You may not see much profit for a while.

Keep perspective

The defensive advantage here is clear, but interested investors should still be aware of the situation. Annaly is not a good choice as a primary underlying holding in a long-term portfolio. And if your current goal is to survive a market crash, you may want to consider other types of defensive trades, such as gold or bonds.

Nonetheless, Annaly Capital Management is currently the most promising investment for even a portion of your portfolio, as it is far from the mainstream stock market but can still generate net returns similar to the stock market.

Should you invest $1,000 in Annaly Capital Management right now?

Before buying Annaly Capital Management stock, consider the following:

that Motley Fool Stock Advisor The analyst team just confirmed what they believed. Top 10 Stocks Investors should buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the coming years.

When do you consider it? Nvidia We compiled this list on April 15, 2005… If you had invested $1,000 at the time of our recommendations, You will have $731,449!*

stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on portfolio construction, regular analyst updates, and two new stock recommendations each month. stock advisor There is a service Increased by more than 4 times The recovery of the S&P 500 since 2002*.

*Stock Advisor returns returns as of August 26, 2024.

James Brumley The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Public Policy.

Will the stock market crash? Who knows? So I’ll own these high-yield dividend stocks. Originally published by The Motley Fool.