Lambert: It’s hard to understand why there aren’t air quotes around the “engineering” in “financial engineering.”

Written by Wolf Richter, editor of Wolf Street. Originally published by Wolf Street..

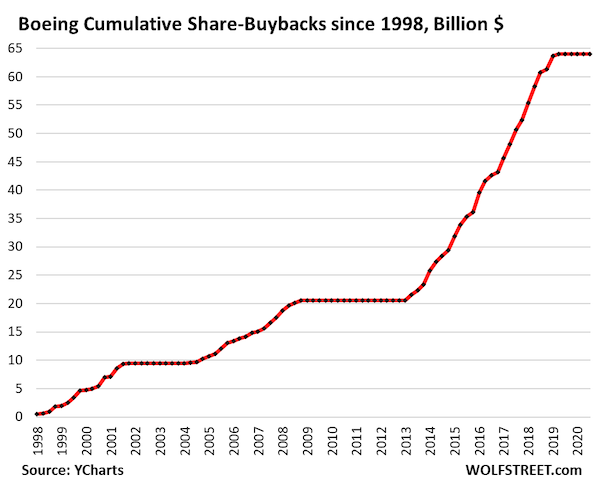

Boeing has recorded net losses totaling $32 billion every year since 2019, and is currently in the red as it borrowed massive amounts of money during that period, increasing its short-term and long-term debt to $58 billion while consuming shareholder equity. The company desperately needed a lot of cash to burn after wasting $64 billion on share buybacks, leaving $23.6 billion to grow its stock.

The company’s infamous shift from aircraft engineering to financial engineering to satisfy Wall Street turned into a huge mess, including for shareholders. Wall Street loved it then, with the stock soaring 500% between 2013 and its peak in early 2019. However, the stock price then plummeted, giving up most of the profits and returning to its original state 11 years ago. before.

So today, after several days of rumors about a stock offering, Boeing presentation It’s a large stock offering that could undo some of the damage done to the balance sheet by buybacks, and it will also dilute the reputation of current shareholders.

We plan to sell 90 million shares of common stock (approximately $14 billion at current stock prices) and $5 billion of required convertible preferred stock that qualifies as capital for credit rating purposes. So that’s about $19 billion. It also granted the underwriters options for an additional 13.5 million shares (worth $2.1 billion at current prices). And according to the semester table: ReutersYou can increase the mandatory convertible to $750 million.

Combined, this brings the total capital raised to $22 billion.

The mandatory convertible preferred stock is being sold to investors at a 6.0 to 6.5 percent dividend and a 17.5 to 22.5 percent premium to Friday’s closing price of $155.01. The maturity date is October 15, 2027, according to Reuters.

This proposal brings in much-needed equity capital that the company had recklessly burned through share buybacks prior to 2019. And this will significantly plug the huge hole of negative equity of $23.6 billion.

If Boeing actually were to raise the full $22 billion, it would be able to reverse about half of the balance sheet losses it incurred from its $43 billion share buybacks from 2013 to 2019. These buybacks led to a 500% surge in the stock price by early 2019, rising from $75 to $450.

Now they are priced at around $153 for the first time in February 2015. This is a decline of approximately 66% from its peak. collapsed stocks (Data via YCharts)

The dilution of existing shareholders resulting from the stock offering will be significant. There are 618 million shares outstanding, with the addition of 90 million shares being offered today diluting existing holders by approximately 15%. This is before mandatory conversion of the convertible notes and an option for an additional 13.5 million shares granted to the underwriters. So if Boeing actually becomes profitable again, earnings per share will be diluted by at least 15%.

Boeing halted share buybacks in 2019 as its troubles mounted after the crash of two of its ill-fated 737 Max 8 planes. Instead of wasting and burning $43 billion on stock buybacks from 2013 to 2019 and $20 billion in the decade before the financial crisis, for a total of $64 billion, the company should have developed a new plane to replace the 737. We fired a financial engineer and hired several aircraft engineers. Y chart).

Boeing’s corporate credit rating is currently one level higher than junk ratings such as Moody’s (Baa3), S&P (BBB-), and Fitch (BBB-). There were fears of a downgrade to junk status due to cash flow problems, production and quality issues, massive debt and a 33,000-worker strike that halted most production in September (our cheat sheet Corporate credit rating from credit rating agency).

A junk credit rating will make it more difficult and expensive for Boeing to raise the funds it needs to cover its massive cash outflow and repay $12 billion in debt maturing in 2025 and 2026.

Raising the stock, as outlined today, will give the company limited financial breathing room and help it avoid a near-term downgrade to junk status. But it won’t solve the decades of damage done to the company by production and quality problems around the aircraft, labor issues, and top-down financial engineers.